Gold’s Price action climbed to highest level in more than two years as investors piled into safe heaven assets due to geopolitical concerns. Investors turned to risk off mood after UK votes to leave the Euro zone. Gold advanced as much as 1.1 percent to $1372.00 – the highest level since March 2014. Price action is now testing the resistance level $1360.00.

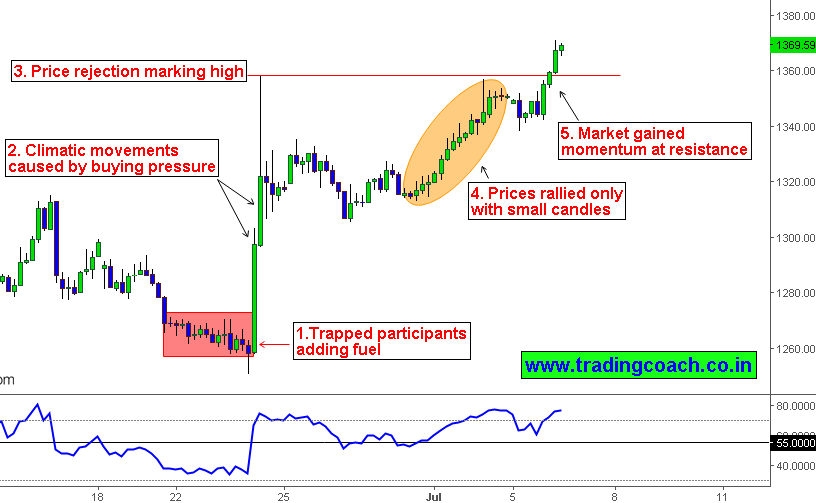

Gold Price action trading on 4h chart

1. Smart money players trapped weak hand participants and influentially forced them to liquidate. The resulted dynamics added fuel to the price gains – We can see this structure on Price chart

2. Buying pressure increased exponentially causing price gains to become climatic movements. Gold jumped from $1260 to $1360.

3. Technically, advances are curtailed when gold reached $1360 and gains couldn’t sustain above the zone. Price action rejected sharply from the level signaling the sellers.

4. An interesting aspect is to notice that gold rallied with small candlesticks from $1320 to $1360. Price actions tell us that, even though liquidity is less but market sentiment is strong enough to make such substantial movements. Usually these kind of movements are caused by weak hand players

5. Gold bounced again to test the resistance level $1360. We can notice that momentum gained sharply, when price action tested the key level. It’s likely a tactic of smart money players to lure in weak hand participants.

Traders should notice how price action reacts after testing the resistance level $1360 in sync with momentum to make further estimates of market sentiment and bias. Always remember that Observation is a key part of price action trading