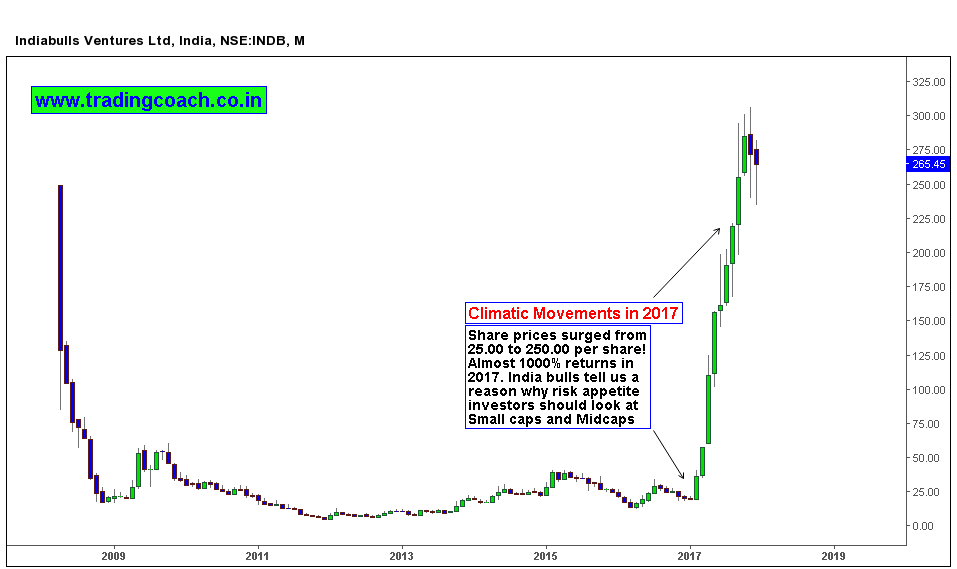

Year after year, Indian small-cap stocks are delivering big alpha to the investors. Since January, investor’s wealth has almost doubled because of the 150 stocks from the BSE small-cap index. On a year to date basis, the index nearly soared 50 percent and each of the HEG and India bull ventures surged over 1000 %. During the same period, there was a rise of 300 % to 850 % in V2 Retail, Avanti Feeds, Bhansali Engineering, Bombay Dyeing and Graphite India.

India Bulls Ventures soared almost 1000% in 2017

As per Experts’ opinion all these stocks can deliver big returns in 2018 as well. Although past performance cannot guarantee future returns in stocks (so are the expert opinions!!). Investors can keep an eye on these stocks and it pays to do some fundamental analysis and Price action research.

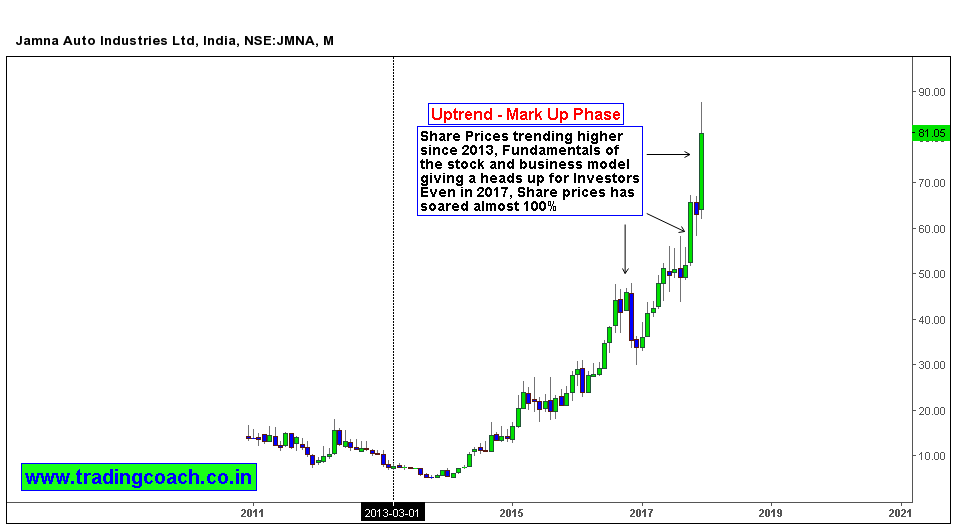

Jamna Auto and GNA Axles have the potential to deliver good return in 2018 because of their business model and optimistic income statement. It’s noticed that the shares of Jamna Auto have soared 101 % and trading at Rs 69.80 in this month, while on January 2 2017 they were just trading above Rs 34.67.

Shares like Jamna Auto Industries have also done a Better Job

During the same period, GNA Axles advanced 112 percent. In January it was at just Rs183.30 and in December it had reached to Rs 388.65.

Many midcap and small-cap companies are on a turnaround path especially after the hit from demonetization and GST rollout. Investors who directly invest in the market and have good risk appetite can look at such small-cap and mid-cap companies with good fundamentals and less debt. Majority of the small and mid cap companies are now embracing professionalism which will pavé the way for minority shareholders to make some potential returns.

On the negative side over 165 stocks in BSE small cap index failed to deliver positive returns to investors despite a bullish outlook in the broader market. In fact, some of them burnt nearly 95% of investors’ wealth in the past 12 months. Yep, so its worth to do some solid research before investing in them.

Small-cap and Mid-cap stocks might become outstanding performers as we climb the mania phase in this structural Bull market. Small caps like Starlite Technologies, Finolex Cables, and Deepak Fertilizers are worth to keep an eye on (Again don’t forget, do look at their fundamentals – business model, and don’t jump in blindly).