Are the Bulls back in the charge?

NSE:NIFTY has been consolidating for some time, in a downward range. The falling volume levels are pointing out the fact that the Institutional Investors are booking their profits at these levels and are not entering into new holdings. Price Action tells us that the market is in a bearish structure, with a lower lows and lower highs.

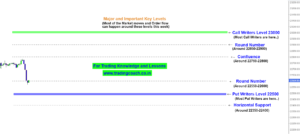

Unless the previous high of 14984 is broken above with a strong bullish candle, NIFTY is still in a neutral – bearish environment

Currently, NIFTY trading in an upswing, with a strong bullish move. Testing the previous high & re-testing the resistance on the downward range.

Unless we see higher volumes and a strong break above the resistance line with a strong bullish candle, we cannot claim that market sentiment has changed into bullish

A breakout with a strong bullish candle towards the upside and rising volume is necessary for us to judge that bulls have taken control of the Price Action. As of now, Market Sentiment is still neutral to bearish; we might see more ranging behavior between the levels of 15250 to 14760.

Rising covid-19 cases, are hinting towards another lockdown, which might lead to a fall back from the resistance levels after testing them.

Traders should keep an eye on the Price action and must take trades accordingly. Don’t rush into the positions or take too much risk in this type of market condition.