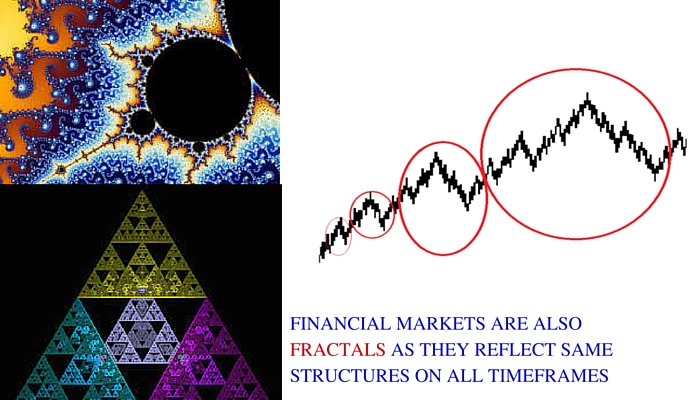

Market structures are fractal in shape and structure. What is Fractal? A fractal is a type of pattern in which the parts resemble the whole. Market structures are fractal in nature, meaning that essentially the same patterns appear on all time frames: Patterns on single-tick charts combine to form 1-minute candlesticks. The patterns on the 1-minute bars are the same as those on the single-tick candlesticks, and they combine to form the patterns on 5-minute bars. This pattern building continues all the way to daily, weekly, monthly, and yearly patterns, which all contain essentially the same patterns.To know about Price action and Market structure, Read here…

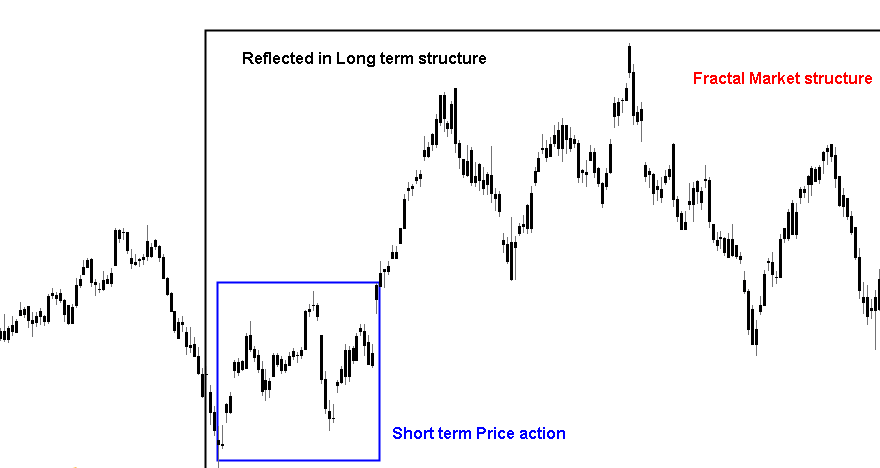

Above picture shows a schematic example of how this might play out in the market. Each trend leg is an impulse, retracement, impulse pattern, and each of those legs also breaks down into the same pattern on the lower time frame. This structure theoretically extends down to the one-tick level. Furthermore, the entire large market structure could be a setup leg for a trend on the next higher time frame.

FRACTAL MARKETS THEORY

The concept of fractals comes from mathematics and refers to a fragmented geometric shape that can be broken into smaller parts that fully or nearly replicate the whole. Intuitively, technical analysis falls within the context of fractals: the foundation of technical analysis focuses on the price movements of assets under the belief that history repeats itself. Following this framework, Fractal Markets theory analyzes investor horizons, the role of Liquidity and the impact of information. The theoretical framework of fractal markets can clearly explain investor behavior during periods of crisis and stability.

INVESTMENT HORIZON AND AN EXAMPLE OF FRACTAL MARKETS

An investment horizon is defined as the length of time that an investor expects to hold assets or securities. Investment horizons can effectively represent investor’s needs such as degree of risk exposure and desired return on investments. As per normal understanding, investment horizons during stable periods tend to balance between short-term and long-term.

Short-term investors will place greater value on the daily highs and lows of an asset compared to long-term investors. However, when a crisis occurs or is forthcoming, Fractal markets theory states one investment horizon will dominate the other. Prior to and during a crisis, short-term trading activity tends to increase more than long-term. Typically, long-term investors shorten their investment horizons as prices continue to fall as observed in a financial crisis. When investors change their investment horizons this causes the market to become less liquid and unstable. It’s an outstanding example of multi time frames interaction and market structure. (Source: Investopedia..)

FRACTAL MARKET STRUCTURES IN PLAY

Fractal Markets theory is an important tool to understand market structure. No market structure exists in the vacuum of a single time frame. The market is like a broccoli, digging into one time frame will reveal similar structures on lower time frames, all the way down to the tick level. Understanding this concept is a key component of building intuition about financial markets. Read about timeframe interaction in this article

Traders usually focus on one specific time frame, but it is important to understand that the patterns of the lower time frame actually create the patterns on the trading time frame, and that the patterns on the trading time frame are influenced by evolving patterns on the next higher time frame. In practice, the interactions of structures on lower time frames are usually components of price action, while higher time frames are more likely to provide context for market structure patterns within the trading time frame.