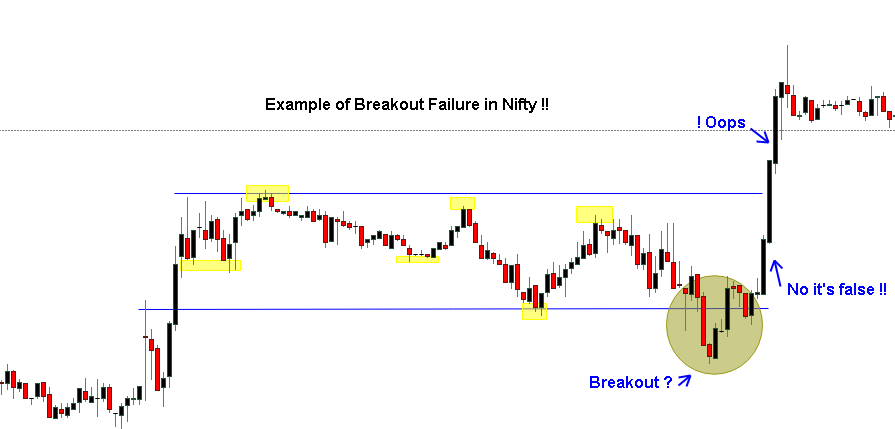

When most traders think of breakout trades, they think of big, dramatic winning trades. However, the trader actually trading breakouts quickly comes face-to-face with a harsh reality: false breakouts are more common than winning breakouts. This doesn’t means breakout trading concept is failure, and it is worthwhile to attempt breakout trades because exceptional reward/risk ratios can compensate for lower probability and provide a trading edge. Furthermore, good breakout traders know how to qualify their trades by focusing on the patterns that tend to support successful breakouts and may have a higher winning percentage than might be expected. There certainly is money to be made trading breakouts, but it is also worthwhile to spend some time thinking about the patterns associated with breakout failures. It is difficult to trade these patterns because it is common for good breakouts to have reactions that violate the breakout level.

Logic behind False breakouts

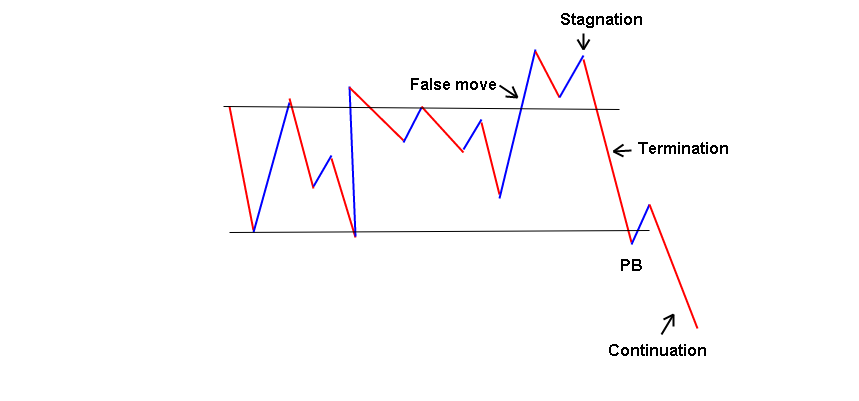

This false breakout triggers all the sell stops placed to protect against a loss from a reversal in upward trend or to enter a new short position. Prices, with no follow-through, then reverse again, and they break back up through the earlier breakout level, leaving many investors with a loss. Those who sold their longs on a protective stop no longer have a position, and those who entered a short position now have a loss. The false breakout down caught them. It is often called as operator breakout from the days when operators and market makers would create false breakouts at prices known to be strong support or resistance levels. Conceptually, this is the most problematic of the trade setups because we have to strike a balance between waiting for confirmation that the breakout has failed while still getting a good trade location. In terms of actual execution, the breakout failure is nothing more than a failed pullback.

Some Important notes

The reaction to a specialist breakout is often so strong and dramatic because it has trapped investors in the wrong direction. In itself, it is a tradable formation. For example, should the trader have no position but see the downward breakout, not trade the breakout, he or she could place a stop above the breakout bar in case the breakout is false. Whether these false breakouts are manipulations today is somewhat irrelevant, but they do occur often and, if not protected against, can be very painful.

This is the most complex and least well-defined of the major trade setups. Traders are probably best advised to focus on this trade if some success is achieved with the other setups, but it is important to study these failure patterns even if you only intend to trade breakouts in the direction of the initial breakout. Awareness of how patterns fail and how trades fail can help you limit your losses and manage losing trades. After you have traded many breakouts and internalized many variations of these patterns, you will begin to develop some intuition about them.