Not a big fan of banking stocks or the financial sector, but RBL Bank has been on everyone’s radar for the last couple of days.

The major reason is, stock prices shot up by nearly 30% within the last few days, enough to keep some eyeballs rolling.

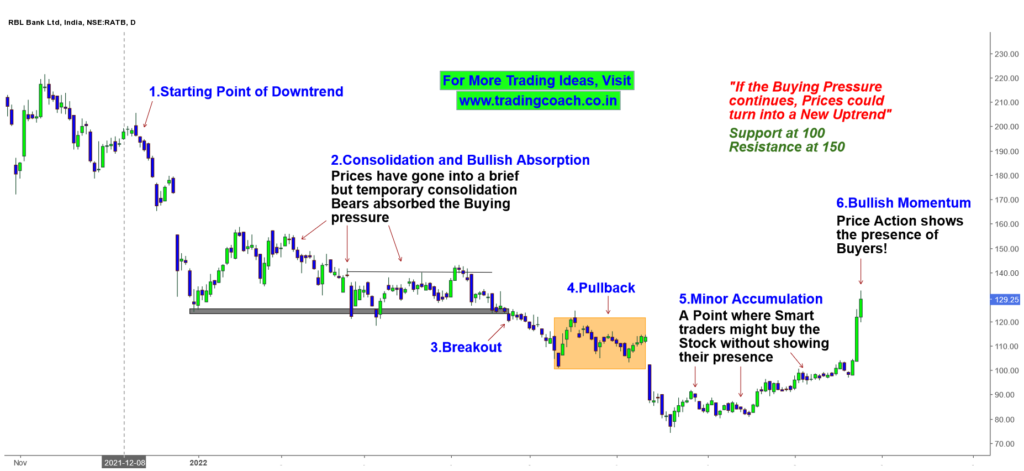

Take a Look at the Price Action Outlook on the 1D Chart

RBL Bank – Price Action Trading Analysis on 1D Timeframe

After touching 80, prices slowly started to rise. It resembled the Minor accumulation Phase, a structure where smart traders could accumulate stocks without showing their presence.

We can notice a strong bullish momentum in the last 2 – 3 days; Price Action reflected the presence of buyers.

If the Buying Pressure continues further, prices could turn into a new uptrend. In case of any failure, prices could turn into a range or Downtrend

The Important support zone is at 100 and the Resistance zone is around 150. Keep an eye on the Price Action and take decisions accordingly. To understand the concept of Accumulation Phase – Take a look at the Video given below…