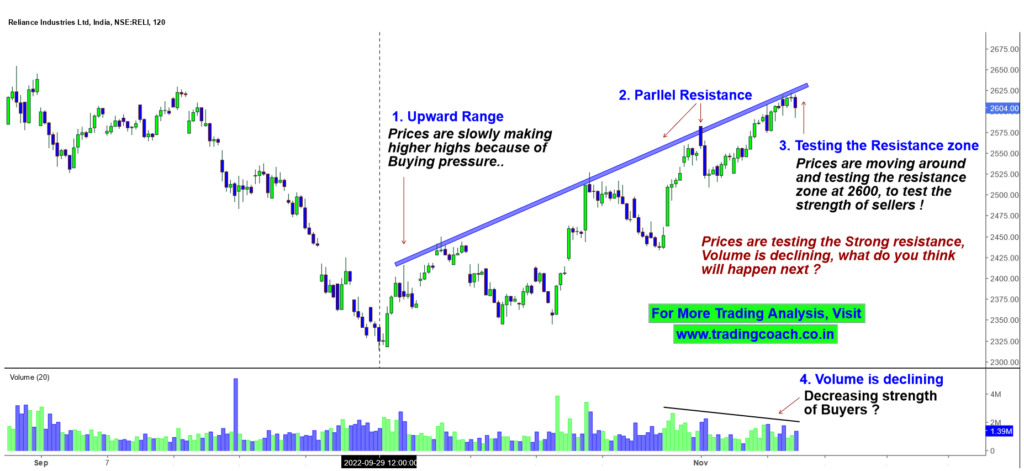

The almighty Reliance Industries, NSE:RELI, has so far given a nice short-term bounce. Prices have rallied all the way from 2325 to 2600 within a month.

It’s almost a 13% rally in the stock prices. The market made consistent higher highs because of buying pressure and positive sentiment.

Despite the positive sentiment and buying pressure, the Bears are still casting a shadow over the stock. Take a look at the chart.

Reliance Industries – Price Action Trading Analysis on 2h Timeframe

Notice the strong parallel resistance zone, where the sellers are consistently stopping the advance. The market is consistently testing the strength of sellers.

As of now, the Parallel resistance zone is around 2600; prices are moving around and testing the resistance zone once again.

Also, take a look at the volume. It’s declined since the beginning of November. Does it indicate a decreasing strength of buyers?

So overall, prices are testing the resistance zone. Volume is declining and there’s a fierce battle between buyers and sellers.

To understand more about analyzing the Parallel Support and Resistance zone, checkout the video given at the end.

I am expecting prices to dip further. However, I will also be looking for a specific upside breakout if the relative price strength continues. Who do you think will win? What’s likely to happen next? Share your opinion in the comments.