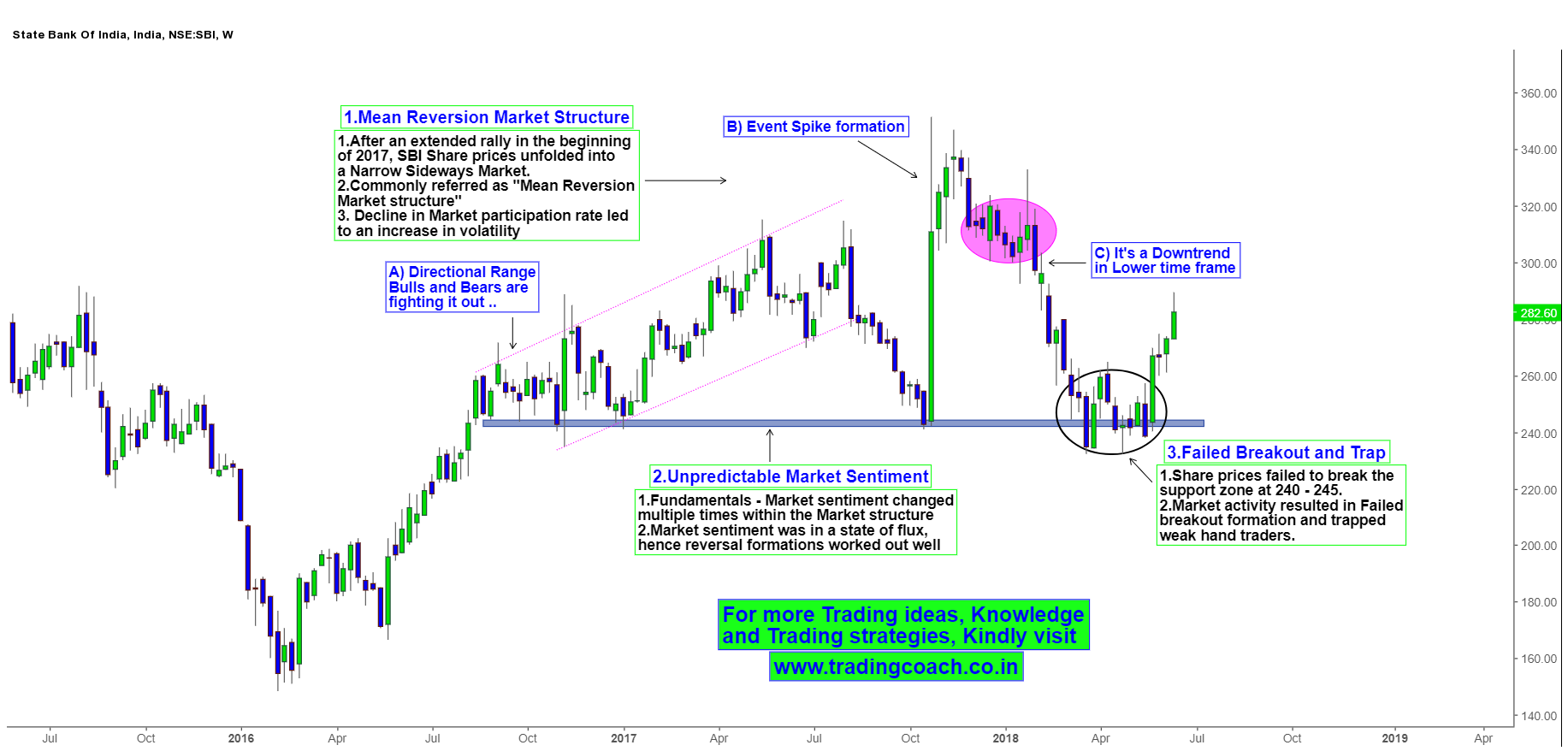

For almost 8 months, SBI Share prices are trading in a narrow Sideways Market condition also referred as Mean Reversion. A structure in which Range bound strategies and non – directional volatility techniques works out well. Average mean value of the Stock is 300; prices are constantly fluctuating up and down within this mean value. Right now, Traders must focus on support zone at 240 – 245 in weekly chart. Outcome from the zone is crucial to determine the future market direction. Before we further delve into the analysis, keep in mind, this outlook is suitable for swing and positional trading.

SBI Price Action Analysis on Weekly Chart – Long term Outlook

When we look at weekly chart of SBI, it’s pretty obvious to spot increasing volatility in Share prices. Since from Oct 2016, Market sentiment is in a state of flux. Fundamentals and Investor’s perception changed multiple times. Sometimes even Price movement influenced the Market sentiment and behavior. Share prices made multiple attempts to expand from the Range, but didn’t go through. These are the main reasons for increasing volatility in stock.

In the recent context, Share prices made another attempt to break the support zone at 240 – 245, but failed. This Failed Breakout formation has trapped weak hand traders and now their liquidation is pushing the prices upside. Will this liquidation turn into a Major rally? or Is there any possibility of selling pressure interrupting the upside movement? Traders must watch the developing Price action for answers and trade according to resulting Market behavior.