Looks like the Broad markets are trying to rebound after a shallow retracement. Just like the Broad Markets, SBI Stock Prices are exhibiting a similar behavior

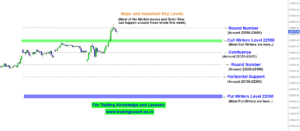

SBI Stock Prices are trading around an important support zone at 400. Overall Market Structure is in Sideways. We can expect some sharp movement on Stock Prices in coming days. So make sure to keep an eye on the Price Action. Here’s the Chart Analysis of SBI on 4h Time Frame

Price Action Analysis of SBI on 4h Chart

If you see the Price Action of SBI Stock Prices, you can notice that Prices are trading around an Important and obvious support zone at 400. Right now prices are retesting the support zone for the second time. But so far we haven’t seen any significant Buying Pressure.

Along with that, you can also notice the declining Volume. The Volume is falling consistently since from the mid of August after the Large spike.

Considering both Points, we can say that Buyers are losing the strength. In order for Stock Prices to shoot up, we need to see strong Bullish Trending Candles from the Support zone, which will show the conviction of Buyers. Incase if you don’t know what trending candles are, take a look at the Video Below, I have explained the Price Action concept in depth.

On the Other hand, if Bulls continue to lose strength, Prices will easily break below the Support zone and fall even lower. It’s better to keep an eye on the Price Action and take trades according to resulting market behaviour.

So what do you think? Which direction SBI Stock Prices are headed? Leave your comments.