So in this content let’s look at an interesting price action that is taking place in SBI – State bank of India 1D Chart. Let’s understand the Price action and the volume in correlation with the price action so we can recognize what’s actually happening behind the scenes of SBI Stock Prices.

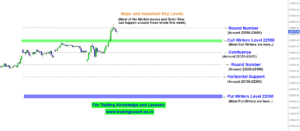

We can see that the SBI stock prices are consistently moving in a sideways market, the prices are not trending upside neither the prices are trending to the downside, instead what we see is a Range bound behavior. Take a look at the Price Action Analysis on 1D Chart

SBI – Price Action Analysis on 1D Chart

We can see this Range bound behavior exactly from February 2021, the highest point the prices touched this year is somewhere around 426, so it is trading around the same zone, all these months.

Along with the Range bound Price Action, we can also notice a Declining Volume which indicates less trading activity and order flow coming into the market. I have explained more about this on the video, check out the Video link given below…

Based on these observations, we can conclude that SBI Stock Prices are likely to experience more Volatility and Uncertain market direction in upcoming days. There’s also a Possibility of Prices breaking the Support or resistance zone.