“If you make a good trade, don’t think it is because you have some uncanny foresight. Always maintain your sense of confidence, but keep it in check.”

For those who’re not familiar with Paul Tudor Jones, Here’s a Short Bio. Along with Paul Tudor Jones uncanny wisdom :

Paul Tudor Jones (born September 28, 1954), is the founder of Tudor Investment Corporation, a private asset management company and hedge fund. As of March 2014, he was estimated to have a net worth of US$ 4.3 billion by Forbes Magazine and ranked as the 108th richest American and 345th richest in the world. He started working on the trading floors as a clerk and then became a broker. In 1980, he went strictly on his own for two and a half profitable years, before he “really got bored”. He then applied to Business school, but later dropped out, on which he later confesses “they’re not going to teach anything. Trading skill set is not something that they teach in business school.”

RAISING TO FAME

One of Jones’ earliest and major successes was predicting Black Monday in 1987, tripling his money during the event due to large short positions. Jones said his partner Borish anticipated the crash in 1987 because Borish had mapped the 1987 market against the market preceding the 1929 crash, and noted the similarity between the two markets.

Jones previously served as a director of the Futures industry association and was instrumental in the creation and development of an education-arm for the association—the then Futures Industry Institute, a research institute later renamed the Institute for Financial Markets based in Washington D.C.

The Tudor Group, consisting of Tudor Investment Corporation, is involved in active trading, investing, and research in assets across fixed income, currencies, equities, and commodities asset classes and related derivative and other instruments in the global markets for international clients. The investment strategies include, among others, discretionary global macro, quantitative global macro (managed futures), discretionary equity long/short, quantitative equity market neutral and growth equity.

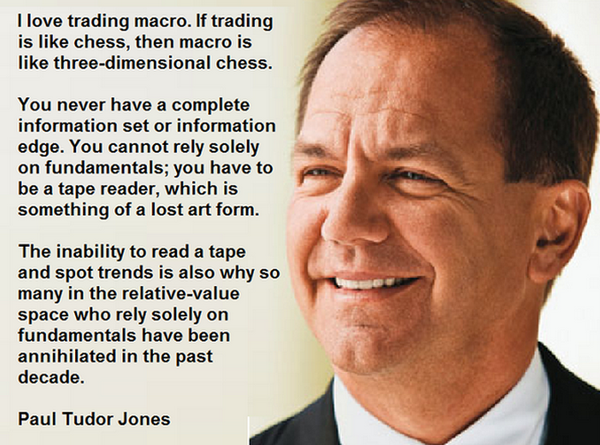

TRADING STYLE

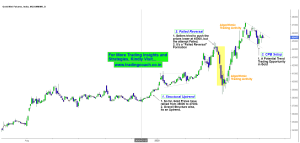

Paul Tudor Jones is a Discretionary trader. He emphasizes the use of Price action to be a successful trader. Jones is a gut wrenching contrarian trader, and doesn’t hesitate to pick tops and bottoms in any markets. Perhaps he encourages that good trading is a part of going against the crowd. Risk control is the essence of Jones’ trading style and success. He never thinks about what he might make on a given trade, but only on what he could lose. He mentally marks each of his positions to the market.

Paul Tudor Jones is a Contrarian – He strives to buy and sell turning points. Keeps trying the single trade idea until he changes his mind, fundamentally. Otherwise, he keeps cutting his position size down. Then he trades the smallest amount when his trading is at its worst.

Belief and Tactics

TOP QUOTES FROM PAUL TUDOR JONES

“Don’t ever average losers.”

“Decrease your trading position size, when you are trading poorly; increase your position size when you are trading well.” (Similar to risk management system, I cover in the premium course)

“Never trade in situations, where you don’t have control.”

“If you have a losing position that is making you uncomfortable, the solution is very simple: Get out, because you can always get back in.”

“If you make a good trade, don’t think it is because you have some uncanny foresight. Always maintain your sense of confidence, but keep it in check.”

“I am always thinking about losing money as opposed to making money.”

“To be a good trader, you need to be a contrarian.”

“Risk control is the most important thing in trading.”

“I believe the very best money is made at the market turns.”