Volatility

RELATED postS

5 Min Read

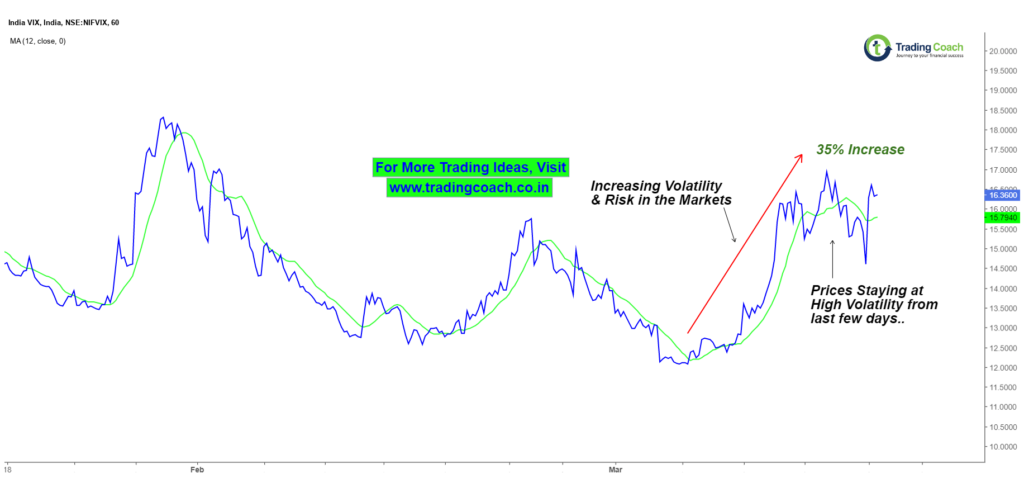

Volatility is increasing once again and market indices like Nifty and Bank nifty are continuing to feed positive sentiment to investors and traders. In

From last couple of weeks I am receiving multiple messages from readers and clients, enquiring about the status of Financial Markets, not just related

Just a couple of weeks back in my recent article I pointed out that Yes Bank Share prices are at Inflection point. For the

Surprises in stock market happen every once and then. This time, it’s all about PC Jeweller share prices. Since the beginning of 2018, stock