TCS reported a net profit of 6,317 crore in the first quarter of the financial year 2016-17. Price action made consecutive highs few days before the announcement. It’s a perfect example of market dynamics discounting fundamental reports and events. The average consensus estimate was 6,059 crore and company announced interim dividend Rs. 6.5 per equity share, which will be paid to share holders. The structural rise on price action was due to estimate surpassing the assessed forecast.

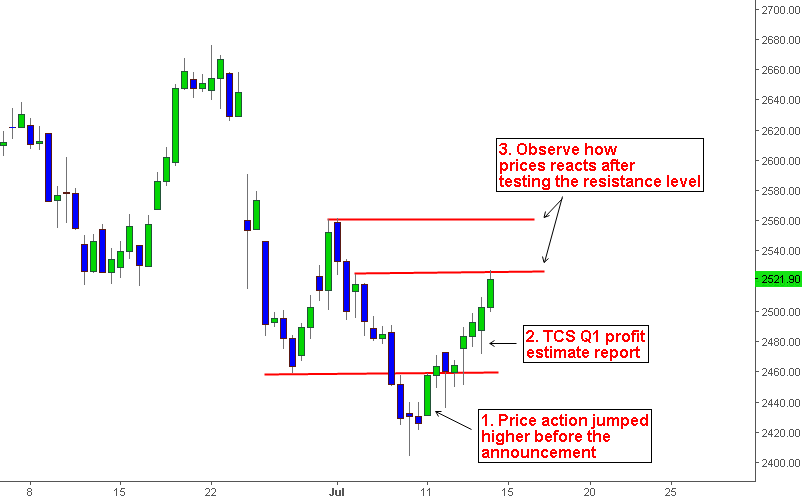

4h chart of Tata consultancy service share prices

1. We can notice that price action jumped starting from July 11, before the announcement. The prices continued to make higher highs on Lower time frame.

2. Price gains accelerated, after announcing Q1 profit estimate. Smart money players have kept intact with market direction and flows.

3. We need to observe how price reacts after testing resistance levels 2520.00 and 2560.00, in order to make proper conclusion about trading bias. Determining trading bias will in turn help us to make directional trades.

Key Highlights from Q1 announcement.

Dollar revenue growth is 3.7%.

Net profit declined on quarter to quarter basis around 0.4% through average calculation

Volume growth is 3.4%

EBIT margin fell from 25.9% to 25.1% in the previous quarter.

Traders should watch price action at key support and resistance levels and keep an eye on upcoming central bank policies which can have direct effect over share prices.