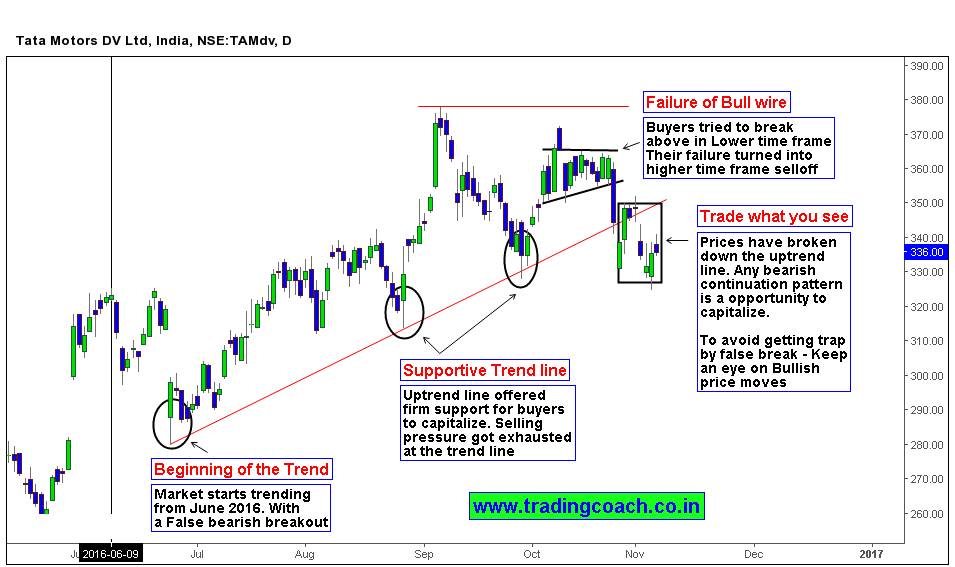

Following my earlier update on Tata Motors DV share prices, Market has broken the long-term uptrend line which was intact since February 2016. As I pointed out before, the moves are reflection of Long term investors exiting their positions due to uncertainty in Tata Conglomerate. My current Price Action Trading analysis on the stock provides much in-depth insights than the previous update. (Kindly zoom on the Price chart Listed above)

Price action (Learn more about reading Price action in my trading course) has broken the uptrend line and any bearish continuation patterns are a good opportunity to capitalize, given both temporary events and Fundamentals are negative. There are more odds for prices to fall based on the current factors. Traders can look for bearish setups to sell at higher prices and capitalize on potential risk: reward ratio. On the contrary, any strong bullish price moves (such as Impulsive pattern, Breakout failures etc.) may cause us to change the trading strategy.