Titan Company LTD; Titan (NSE) Stock prices have broken out from the long-standing Resistance zone at 1625, with good momentum and strong increase in the Volume. Prices have Rallied 21% so far! Take a look at the Price Action Analysis of Titan on 1D Chart.

Titan Company Ltd. Price Action Analysis on 1D Chart.

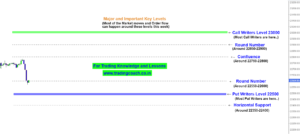

Stock Prices were trading in a Range bound /sideways market structure for almost 6 months, since from the beginning of January 2021. The Market behavior was oddly struck between 1600 and 1400, without any sharp movements. During the process Important Support Zone was created at 1410 and long-standing Resistance zone was formed at 1625 respectively.

In between the range, we can notice some moderate algorithmic trading activity which created a Wyckoffian absorption pattern, closer to the resistance. The Absorption pattern indicates the behavior of Algorithms trying to absorb the sell orders and create a pressure to break the Resistance. We also have a False Breakout at the Support Zone, which trapped uninformed sellers who took positions on the downside.

After these interesting patterns and setups, now we have a very good Breakout in Titan Stock Prices. As I mentioned before, the breakout has a strong momentum as well as good volume. There’s a good possibility of stock prices moving higher. However we can’t ignore the tendency of the market to reverse, incase if any negative events interfered.

If buying Pressure sustains in the stock, market could go all the way till 1750. On the other hand, if we see any strong selling activity, prices could fall below 1600. Traders should keep an eye on the Price Action and trade accordingly.