One of the Iconic Traders of all time, George Soros famously said – “I am only rich because I know when I am wrong. I basically have survived by recognizing my mistakes” If you ponder deeply, this is an excellent advice on what it takes to be successful in trading.

Most of the uninformed traders think and believe that successful trading is a result of excellent analysis. They often end up with the notion that accurate analysis leads to profitable trading results. But the truth is other way around – Successful Trading is more about surviving your mistakes, downsides and risk factors that comes along in your trading journey. It’s more about improvement than excellence.

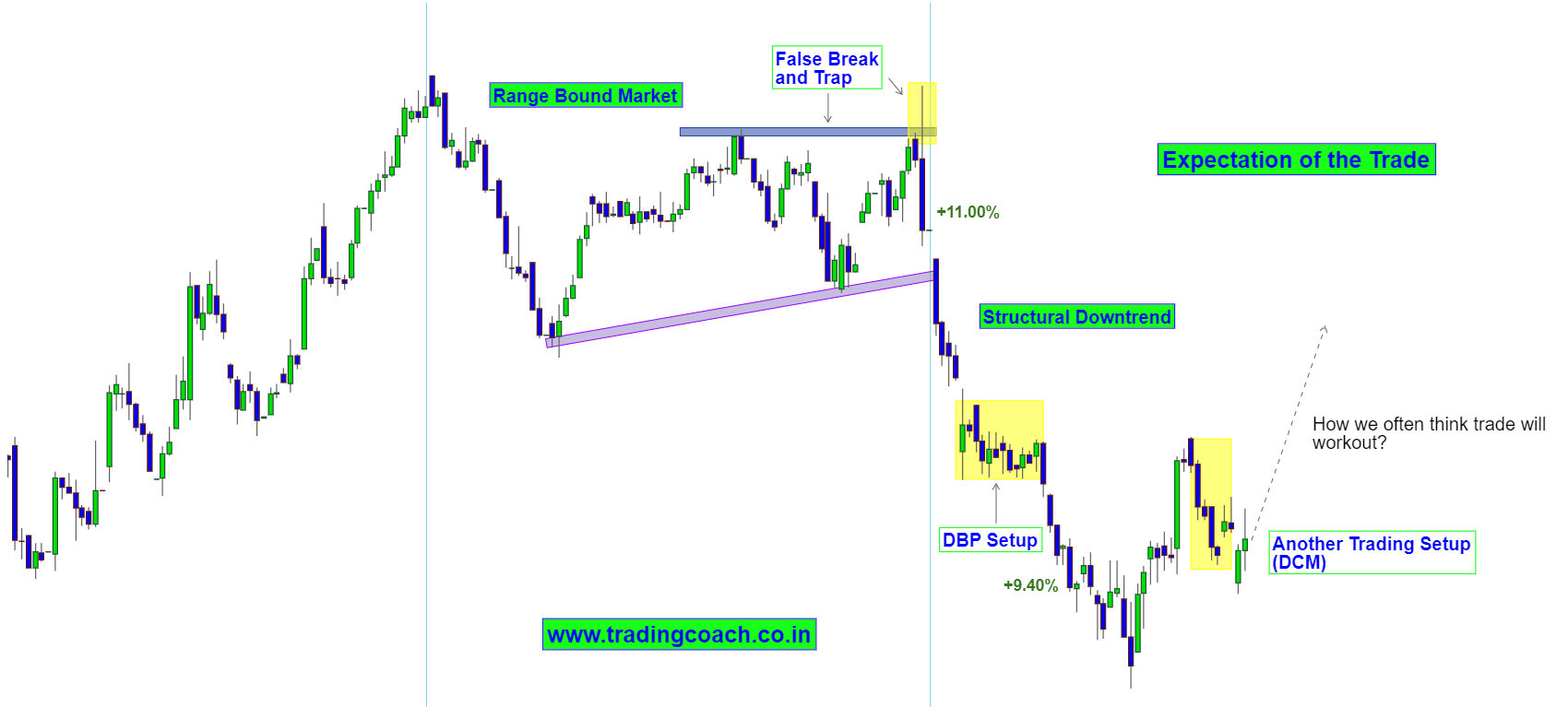

No matter what kind of techniques you use, what kind of systems you implement or what kind of markets you trade – you can’t escape the probability in financial markets. Your perfect analysis could and will fail to work at certain point in time. Why? Because there are always multiple outcomes and possibilities in any given trade. Take a look at these Images

Expectation of the Trade

Probabilities of the Trade

Out of the three possibilities you see on the diagram, which one do you think is likely to play out? Could you guess? Well to be honest, all of them have equal chances of working out! Couldn’t believe? That’s called probability!

So if that’s the case, then how does one take a good trade? That means Analysis and strategies are meaningless?

For precisely answering this question, let’s bring another important quote of the legendary trader George Soros – “It’s not whether you’re right or wrong, but how much money you make when you’re right and how much you lose when you’re wrong” – that’s how professionals approach the market.

Design Strategies to Find Asymmetric Trades

To put it in a simple sense, your analysis should be focused on finding individual trades which has higher reward potential than expected risk. You need to design a strategy that helps you to spot such “Asymmetric trades”

For example, in the above diagram, we could’ve still gone for the trade as per our expectation, if it had lesser stop loss compared to assumed profit potential, despite multiple possibilities and outcomes. So if the trade works out in our favor, we could get a good potential reward, Incase if it doesn’t then we might end up with a legitimate loss.

So as a conclusion, the trades we come across will always have multiple outcomes. Think about probabilities and focus the strategy on finding “Asymmetric trades”