Indian Rupee is trading within 100 pips range from 66.00-67.00. Market sentiment is uncertain due to volatility and liquidity. Intermarket relationship between Nifty and USD/INR will play a major role in shaping the market structure. Nikkei Manufacturing PMI data releasing today can influence the investor perception on currency pair. Current Price value of USD/INR is 66.39. Traders should focus on important support and resistance levels.

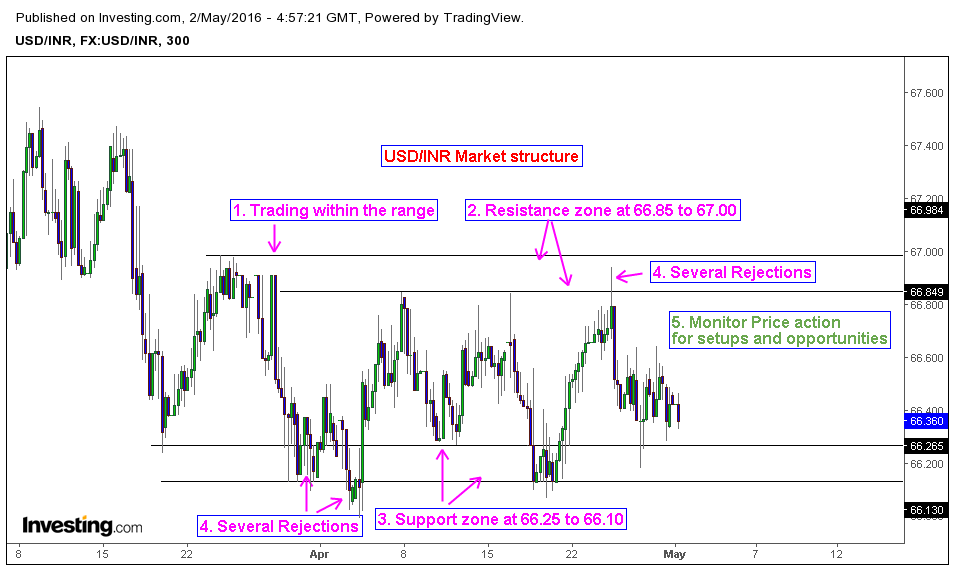

Below is the 5 hr chart of USD/INR with Price action analysis.

1. Price action is trading in a range bound structure.

USD/INR is trading in a stubborn range between 66.00 -67.00 since from the beginning of April. When we look at the price chart it’s obvious to spot market volatility. Price action is more volatile than usual in the currency pair and movement like these can shake out weak hand players constantly. Trading within this range is a futile task because trading edge doesn’t exist.

2. Resistance zone is at 66.85-67.00.

Selling pressure exists at resistance zone 66.85-67.00. Positioning within this resistance zone is a daunting task as market constantly traps the weak hand players. We can see resulting price action after testing the resistance zone, it confirms that selling pressure exists.

3. Support zone is at 66.25-66.10.

Price action tested the support zone at 66.25-66.10 several times which resulted in either a bounce or failure to break the key level. One important fact is to consider that current support zone is also a higher time frame support level.

4. Several rejections around key levels.

Rejection patterns around the key level show the volatility through price behavior. These Patterns form when market shakes out weak hand players. Rejection pattern can also act as a trading setup. For example, Breakout failures are also a part of rejection patterns.

5. Monitor Price action for trading setups and opportunities.

Traders should watch the price action closely around support and resistance zones. We should also note that range trading is a risky business even though profits are rewarding enough. It is advisable to look for high probabilistic patterns and setups.