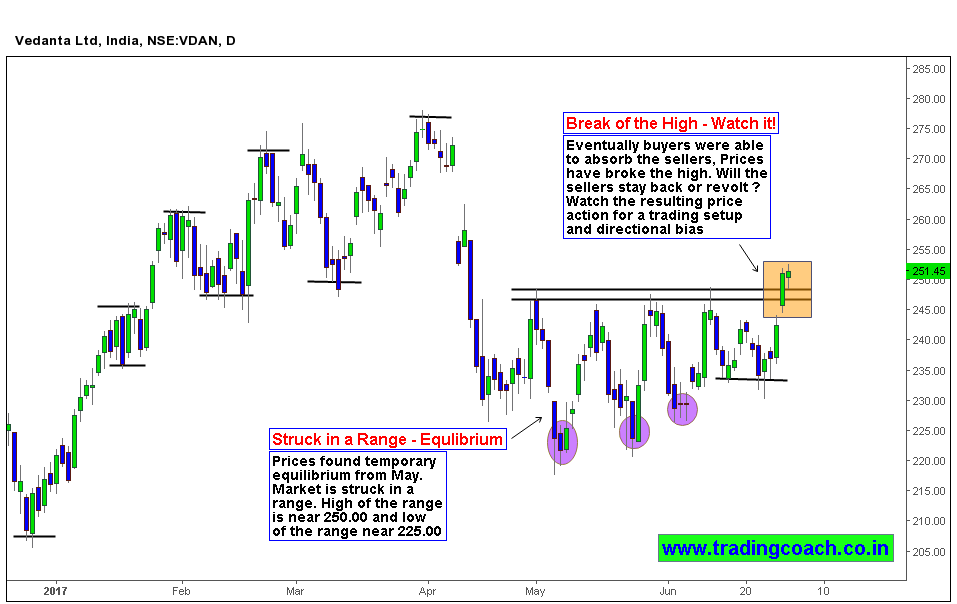

Vedanta shares didn’t shine as much, when compared to other stocks from the same sector. Since beginning of this year to till date, prices are trading in mean reversion context (When Trends are unsustainable due to lack of liquidity, we refer it as mean reversion). If we focus on present conditions or recent market structure its obvious to note that prices struck inside range since May 2017. The high of the range is near 250.00 and low of the range is near 225.00, market should clearly breach either one of these levels to trend or else the conditions will remain same. It may add up to frustration of traders and speculators.

Currently prices have broken the High (250.00) and yesterday’s candle also closed above it. Eventually buyers were able to absorb the sellers temporarily. Does the recent move say market will go higher from here? Well, don’t jump to the conclusions so quickly! What if the breakout fails? Wait and watch the price action for few more days and take trades accordingly. The main key point here is – whether the buyers will be able to absorb the sellers or whether the sellers will revolt back. Most importantly which side the smart money is going to take!