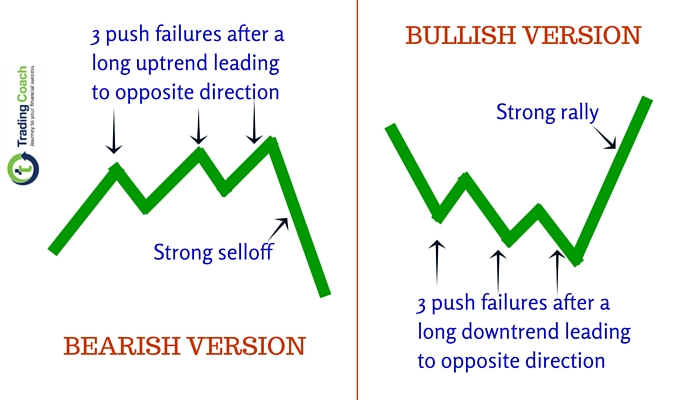

Three push pullbacks is a particular kind of Price action pattern; which signals warning before an end of a trend. We often need to analyze this pattern to confirm its development, with practice and experience; you can recognize this pattern in an easy way. Three push pullbacks is a counter trend pattern; it’s only powerful, if it occurs after a long trending period. We need to analyse this pattern in the context of previous market action. Volume provides a good way to measure the strength of three push pullbacks.

Price action patterns should be considered on the basis of buying and selling pressure

Learn about Price action patterns here

BEHAVIORAL LOGIC OF THREE PUSH PULLBACKS PATTERN

On a strong trending period, price action forms three small scale swings, with low force or intensity. This low force is visible as contracting price swings, which indicates that buying pressure (after uptrend) or selling pressure (after downtrend) is losing strength. These price swings often traps both counter trend traders, who’re early in their entries and trend traders, who’re late in their entries. After enough liquidation or losing the strength, Price turns quickly to the opposite side. Entering before such a move gives a high probability and excellent Risk: Reward setup. Three push pullbacks have the character of accumulation (after downtrend) and distribution (after uptrend) phases.

Swing analysis is a method of analyzing price action. Learn more about swing analysis here

PRICE ACTION SETUP CRITERIA

charting source : Investing.com

The Trend should be over extended and primed for reversal in some way. Three small-scale swings should typically have low volume readings. Price swings are contractive and symmetrical to each other. Since this pattern is a counter trend pattern, it works well on higher time frames. Normally, counter trend traders would look for this pattern after long-term trends on daily or weekly charts. There are two possibilities after three push pullbacks pattern. Either price action moves into a range bound structure or begins to trend quickly in the opposite direction. Volume readings are significantly high when price action starts to trend in the opposite direction.

TRIGGERING THE TRADES

charting source : Investing.com

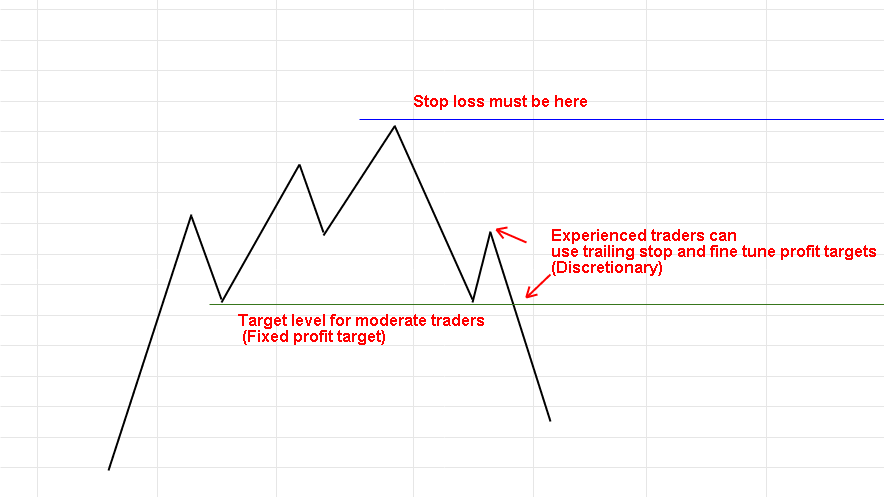

PLACING STOP LOSS

The stop-loss for three push pullback is clearly defined. A clear stop is entered, just beyond the extreme of third swing. In all cases, the stop-loss should be outside the extreme of third swing. Please refer to the picture mentioned above. This is an aggressive counter trend trade, it is important to not hold on losing trades. Pay attention to the price action, after third swing. Respect the stop levels without question. It is better to trade three push pullbacks pattern in smaller size and less risk compared to other setups. Even though the success ratio of this setup is higher, I suggest playing on safer side.

PROFIT TARGETS

Most traders find best success with a plan that allows for taking initial profits. I suggest two different target placements for this setup. One plan is to take profits on a discretionary method like “when profit equals initial risk of the trade or using trailing stop till opposite price action emerges etc” These methods are better for experienced traders. Less experienced traders should constrain from such target placement techniques.

Discretionary management of profits and losses is an essential skill for traders. Read about managing profits and losses

The second plan is to take profits on earlier support or resistance level. For instance, if price reaches a particular support or resistance level, one can liquidate their entire positions. This is sort of fixed plan; it’s quite easy to implement. Placing profit targets in such a fixed term reduces the hassle of discretionary trading. If you’re new to price action techniques or a moderate trader, this method will be suitable for your target placements.

SOME IMPORTANT NOTES

Three push pullbacks is a simple and efficient price action pattern. There is no subjectivity in stop location and little discretionary in target placements. It’s a high probability pattern, but the power of this pattern relies on buying and selling pressure background. We should trade this pattern only after long and sustainable trends. Three push pullback acts as counter trend trading setup, it necessary to confirm that trend is indeed losing strength. Don’t trade this pattern blindly, I have already warned about this several times. We are trading the buying and selling pressure behind three push pullbacks pattern.