The world markets are spooked by Geopolitical jitters and persistent volatility. Many think that the Russia – Ukraine war is the major culprit behind the recent Market Behavior. That may be partially true but there’s another important factor which is driving the institutional traders and investors right now!

The mighty US and its Inflation Rate…

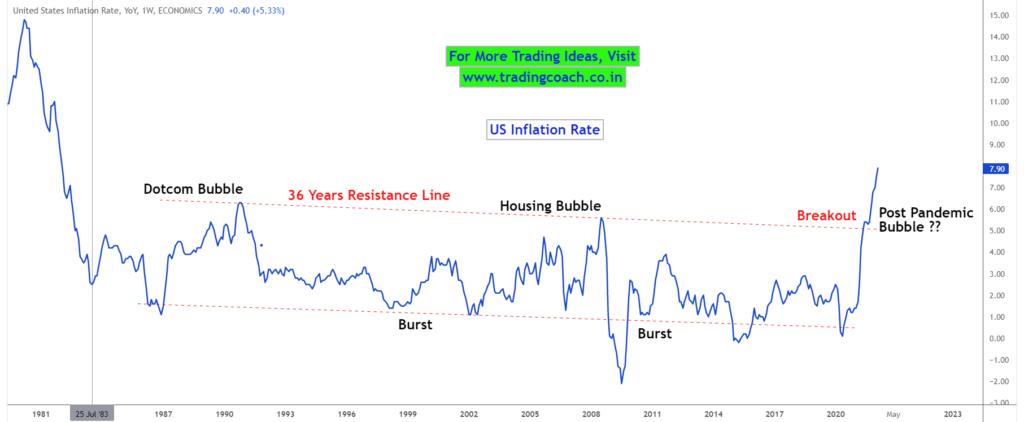

Some of you are already aware of the fact that Inflation has reached new heights across the world. Here’s the chart that visually captures the picture!

US Inflation Rate – Breakout and Alltime highs!

Every time inflation peaked, it has signaled some kind of a Bubble. If History is going to repeat itself, maybe we are experiencing the Post-Pandemic Bubble where prosperity is just another illusion.

Higher Inflation always brought aggressive rate hikes from Central Banks. This could be the major reason why institutional investors are pulling money out of markets. Aggressive Interest rate hikes from FED could start a cascade effect where worldwide central banks might follow one after another in the so-called “Hiking cycle”.

And most of the time, rising Interest rates often creates sharp selloffs and crashes in Stock Prices. Well, this time it could be different or may not be different after all!

Let’s keep an eye, Read the Chart and see how this unfolds.