Back in the day there was a saying on Wall Street – “I have never met a rich technical trader”. But Richard Wyckoff was an exception during the time and his technical trades moved the market!!

According to the Journal of Commerce from Chicago, “Mr. Wyckoff was a clerk, customer’s man, and head of his own brokerage house, market expert, founder and long-time editor of The Magazine of Wall Street. At one time, as a market advisor, he had one of the largest individual followings in the history of Wall Street. His trading capital grew in large size to the point where he owned nine and half acres mansion next to General Motors Industrialist Alfred Sloan’s estate! That itself is a sufficient reason for traders like us to learn more about his ideas and principles.

How did Richard Wyckoff trade the Markets?

Richard Wyckoff was known as one of the most accomplished tape readers of his day. He would observe the market activities and campaigns of legendary stock traders such as JP Morgan, James Keene and Jesse Livermore. With the help of his observations and interactions with these experienced traders, Wyckoff summarized the operations of large market players into specific principles and techniques based on which he designed his own trading method.

Wyckoff also observed numerous retail public investors with losing portfolios and instructed them on “the real rules of the game” as played by the big players or “smart money.” His core concept was to identify the trading activity of large market players through accumulation and distribution of the stock and then take positions in harmony with these large players.

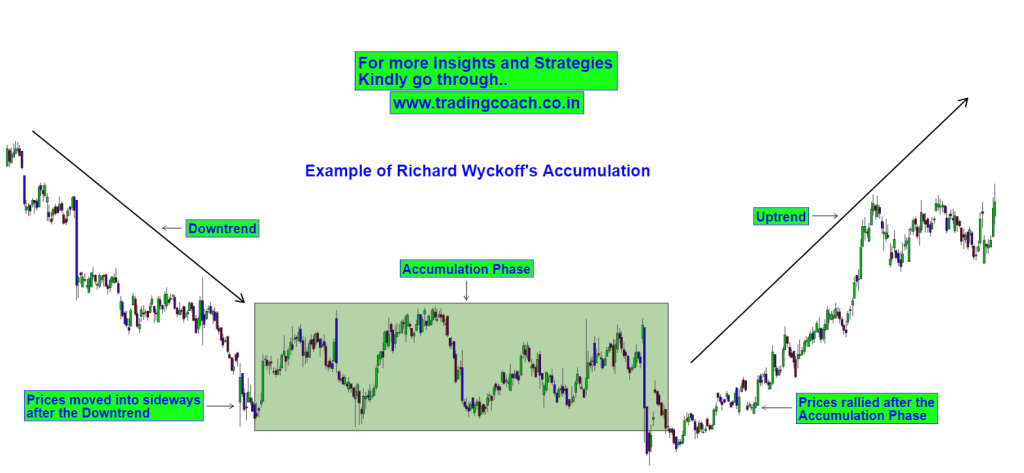

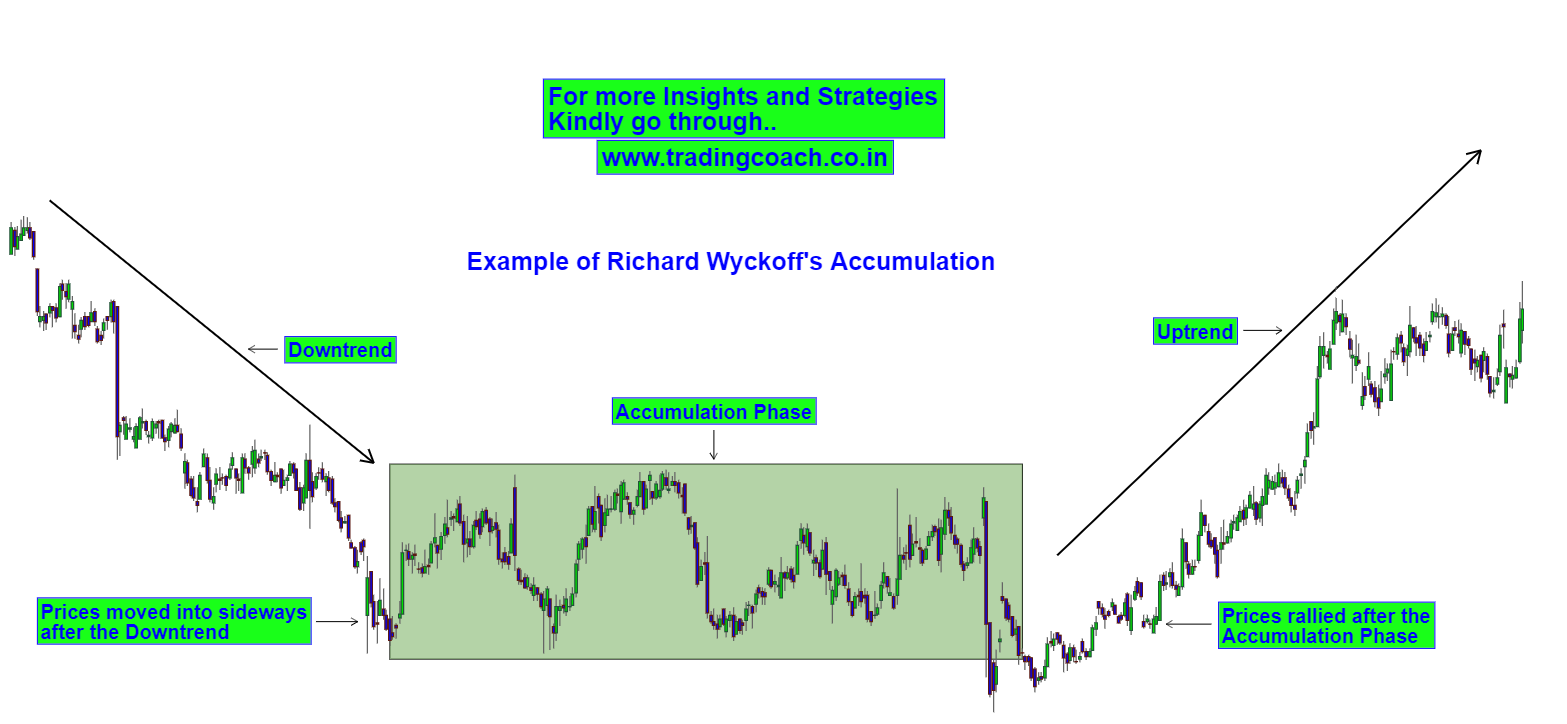

Accumulation Phase

Accumulation is one of the important stages in Wyckoff Market cycle. The Accumulation process takes place due to an increasing demand of Institutional traders and smart money players in a particular stock. This is the phase where smart money players and big institutional traders try to accumulate or acquire their positions without moving the prices too much. The price action on the chart will be in sideways preceded by a downtrend. Often prices will form higher range bottoms in the Accumulation phase, indicating the presence of buyers.

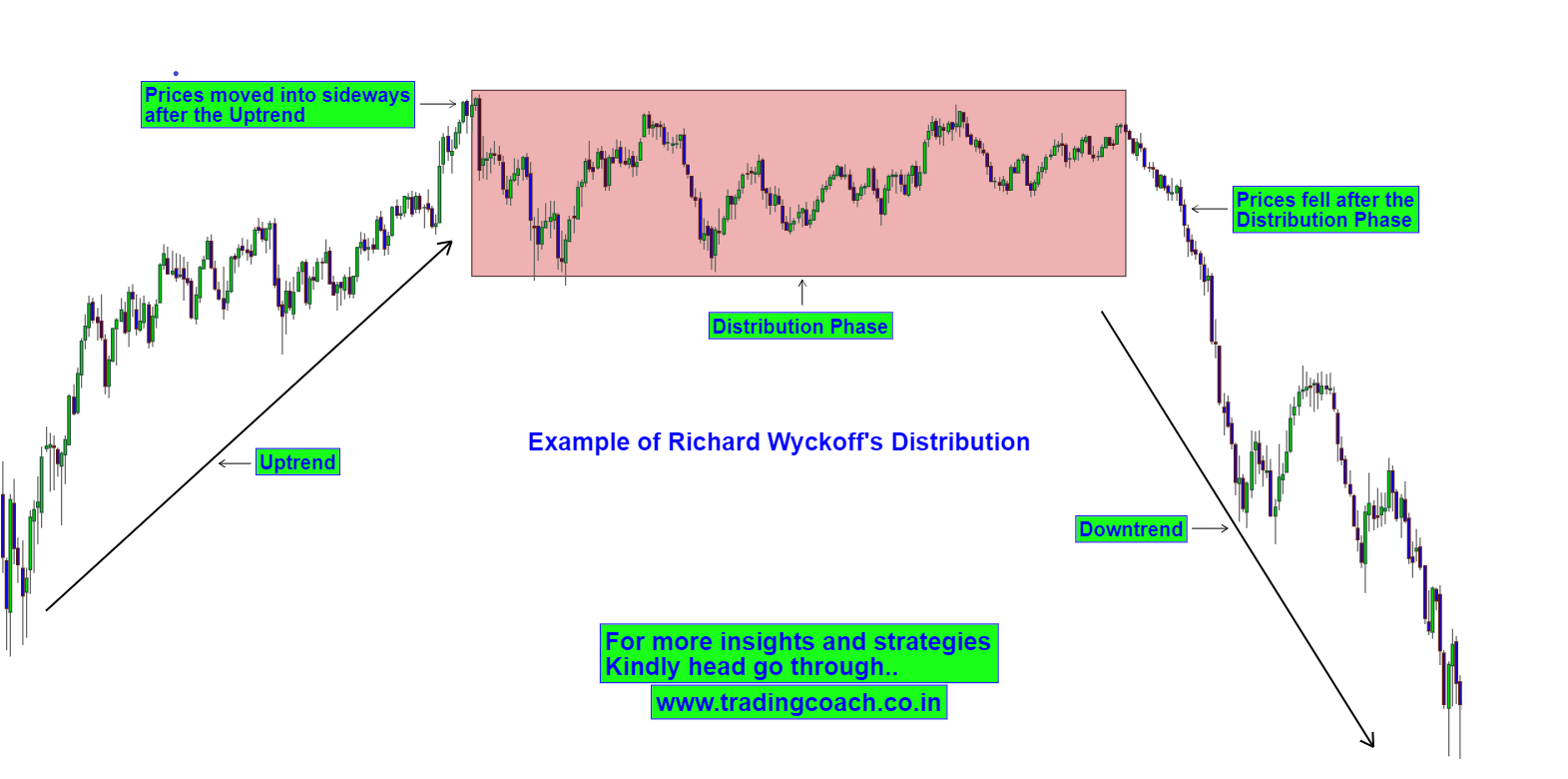

Distribution Phase

Distribution phase is another important stage in the Wyckoff Market cycle. This is the phase where smart money players and big institutional traders try to liquidate or square off their positions without moving the prices too much. The price action on the chart will be in sideways, preceded by an uptrend. An Important characteristic of Distribution stage is that, prices will fail to go beyond an established resistance zone, indicating the authority of sellers in the market.

The Concept of Composite Man

Wyckoff suggested a method to understand price movement in stocks and other financial markets known as The Composite Man.

“All the fluctuations in the market and all the various stocks should be studied as if they were the result of one man’s operations. Let us call him the Composite Man, who, in theory, sits behind the scenes and manipulates the stocks to your disadvantage if you do not understand the game as he plays it; and to your great profit if you do understand it.” – Richard Wyckoff

He would advise the traders to understand and trade the market as if the Composite Man was a real entity and responsible for most of the market movements. He explained the theory of Composite man in the following ways:

• The Composite Man carefully plans, executes, and finishes his trading campaigns.

• The Composite Man attracts the public to buy a stock in which he has already accumulated a sizable amount of shares.

• One must study charts with the purpose of judging the behavior of the stock and the motives of the composite man who dominate it.

• Wyckoff believed that if one could understand the market behavior of the Composite Man, one could identify many trading and investment opportunities early enough to profit from them.

2 Rules of Market Behavior

Richard Wyckoff explained 2 important rules, which he considered as crucial to understand the market behavior:

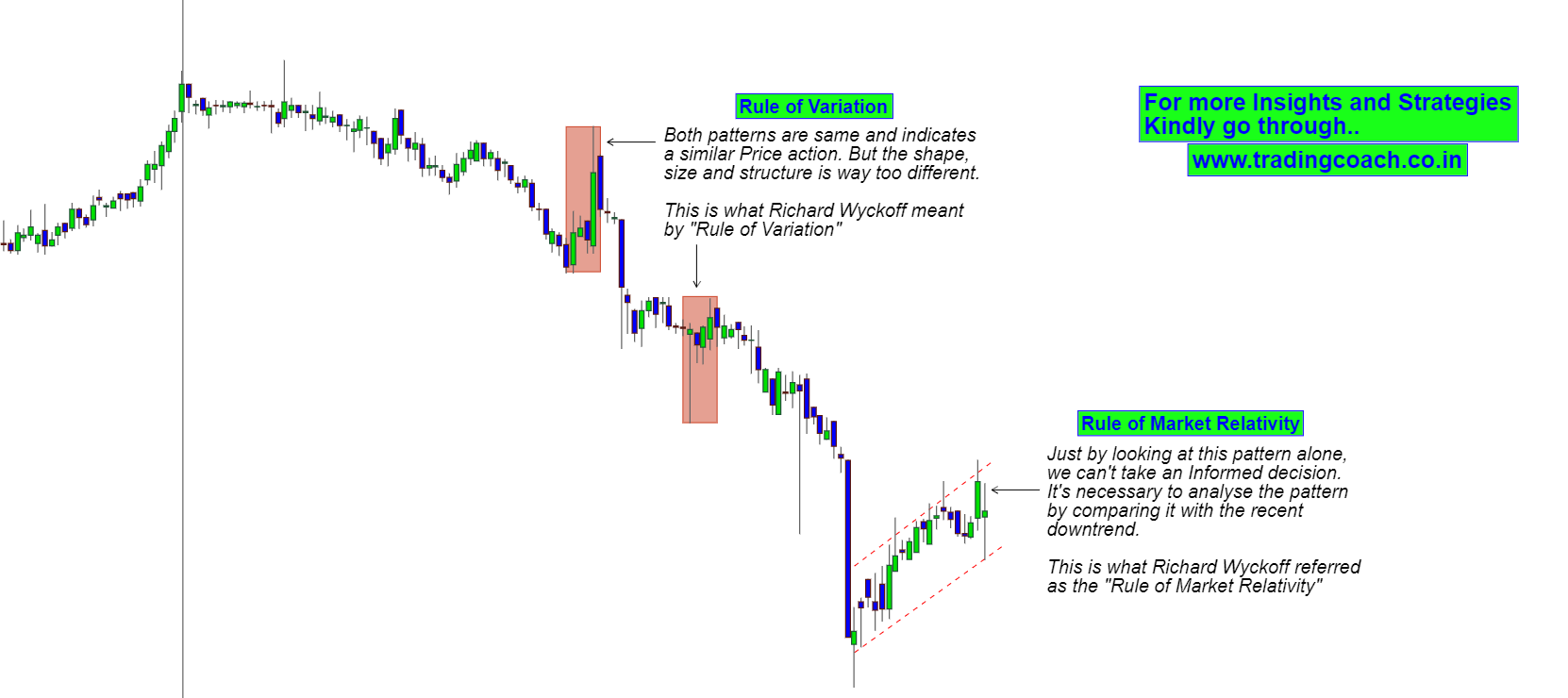

a. Rule of Variation: The market and individual stocks never behave in the same way twice. Markets will always form similar price patterns but with different variations in size, detail, and extension. Each variation is different from prior variations which often surprise and confuse market participants.

b. Rule of Market relativity: Context is everything in the financial markets. The only way to evaluate today’s price action and market behavior is to compare it to what happened yesterday, last week, last month, and last year.

Take a look at the Image to understand the Rule of Variation and Rule of Market Relativity

Importance of Broader Market Index

Richard Wyckoff placed more importance on the broader market Index. He insisted that traders must assess the overall market condition based on broader indices and not by looking at individual stocks. According to Wyckoff, one must select relatively strong or weak stocks as per the shifts in the broader index such as Nifty 500 or Sensex 500.

For e.g: If the Nifty 500 is in uptrend, you should select stocks that are trending stronger than the Nifty 500 for initiating long positions. Likewise, if the Nifty 500 is in downtrend, you should select stocks that are trending weaker than the Nifty 500 for initiating short positions.

Outline of Richard Wyckoff’s Trading Principles

Here’s a quick and detailed outline of Richard Wyckoff’s Principles in an orderly manner:

1. Think and Trade from the Perspective of Composite Man

2. Pay attention to activity of Smart Money Players and Big Institutional traders

3. Track the overall market condition and trend by looking at the Broader Market Index such as Nifty 500 and Sensex 500

4. Select Stocks based on Relative strength and weakness

5. Analyze the patterns and trading setups based on the Rule of Variation and Rule of Market Relativity

6. Buy at Accumulation

7. Sell at Distribution

Nearly a century old, Richard Wyckoff’s approach is still as valuable as they are in the beginning. Both long term investors and short term traders can gain excellent insights by studying Wyckoff’s techniques. Wyckoff’s methods can be applied to any highly liquid markets, in which large institutional players operate – including stocks, commodities, bonds and currencies. Even though some of his strategies are quite old and outdated, his core principles and concepts are proven to work even in today’s highly competitive markets.