Richard Wyckoff believed that Market moved in cycles. In his book, “Studies in Tape reading”, Wyckoff proposed a four-stage Market cycle. His idea was that, this price cycle resulted from the actions of Big players who planned their operations in the market to take advantage of Uninformed Traders and their reaction to price movement.

But to be fair, We can notice this cycle even in the price action of medieval commodity prices! Stocks in the early unsophisticated markets also reflected price action similar to Wyckoff cycle. In some instruments, we could notice the price cycle on lower time frames such as 5 min and 15 min. It is illogical to believe there is the same type of manipulation taking place in all these cases.

In my humble opinion, Wyckoff cycle may simply be an expression of Market Psychology. Price action in all segments and timeframes including currencies, commodities and stocks, tends to move in a structure similar to Wyckoff cycle.

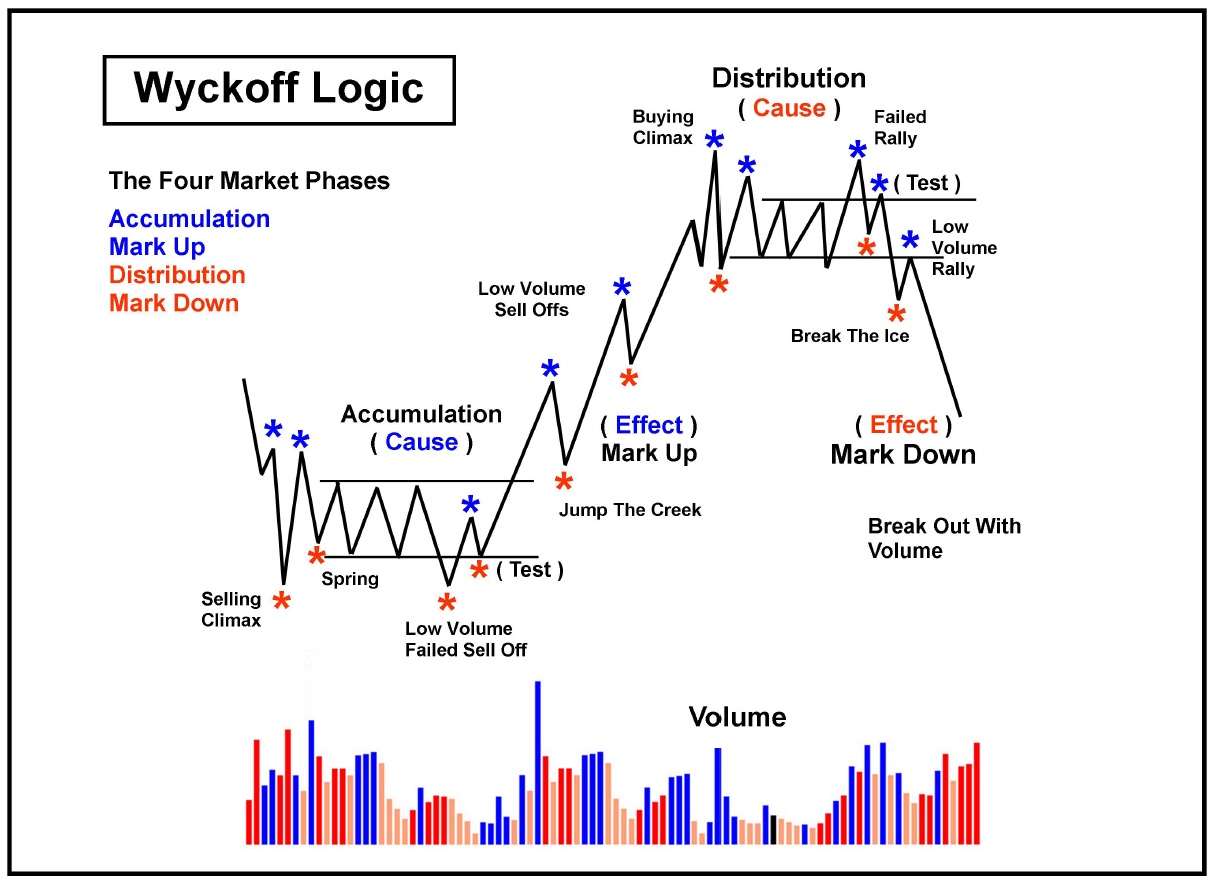

Visual illustration of Richard Wyckoff’s Market Cycle

Here are the 4 Stages of Market cycle as per Richard Wyckoff:

1. Accumulation Phase: A sideways range in which Institutional traders or Big Players buy carefully and skillfully, without letting the prices move too much to the upside. The small players and Uninformed traders will be unaware of what’s happening in the Accumulation Phase; the Stock/Asset is out of the public focus. On the Price chart it looks like a sideways trading range, bounded by rough areas of Support and Resistance.

2. Markup Phase: It’s a classic Uptrend that follows the Accumulation phase. At this point, the small players and Uninformed traders notice the price making higher highs and their buying activity pushes the prices even higher. Big players and Institutional traders who bought in the Accumulation phase might sell some of their positions in the uptrend or they might just hold and wait for higher prices. As the trend moves higher, the early aggressive short sellers will be forced to cover their positions which in turn in pushes the Stock/Asset to new highs.

3. Distribution Phase: Eventually the Uptrend or Markup phase loses momentum and prices enter into a Distribution phase. It is nothing but another sideways range that takes places after an Uptrend. Big Players or Institutional traders sell rest of their holdings within the sideways range and Uninformed traders who are still anticipating higher prices,keep buying the Stock/Asset. Some Institutional traders might even short sell in the Distribution Phase to profit from falling stock prices. On the price chart it looks like Uptrend reversing into another sideways trading range.

4.Markdown Phase: It’s just a classical Downtrend that follows the Distribution Phase. Big players or Institutional traders will initiate more short positions in this phase. The Small players and Uninformed traders realize the falling prices and liquidate their positions in panic. As the Uninformed traders begin to unwind their positions in panic, it creates more selling pressure in the Stock/Asset. In the end, prices will fall even further and makes new lows.

The Model of Group Psychology

After the Markdown phase, the cycle repeats all over again from Accumulation –> Mark Up –> Distribution –> Mark Down

In a simple sense Wyckoff trading cycle is a simplified model focusing on the psychological perspective of two major groups: the Big Players or Institutional traders, who are assumed to be driving the market and the general Uninformed traders or Small players. Wyckoff trading cycle focuses on the group psychology and interaction between Big Players and Small players. It highlights how mistakes and thinking process of Small players benefits the activity of Big players.

Wyckoff trading cycle is an excellent approach to understand the Big picture. But it’s not perfect, it does have some flaws.

Limitations of Wyckoff Trading Cycle

Though Wyckoff cycle provides a useful framework, there are many limitations and problems to apply it in practical trading:

1.It’s hard to properly recognize Accumulation and Distribution phase.Sometimes what looks like an Accumulation turns out to be Distribution, the bottom drops and the market does not look back.

2.It is also difficult to time entries out of Accumulation and Distribution. Buying within the Accumulation or selling within the Distribution is not simple, as there are no clear levels to place stop losses. Setting stop losses around Support and Resistance is usually wrong and subjected to traps.

3.Trading Markup and Markdown trends are also not as simple as it sounds. Many Price Action Patterns that occur in them, it takes real skill to identify and trade these patterns. In the modern markets, trend reversals are more common than trend continuations.

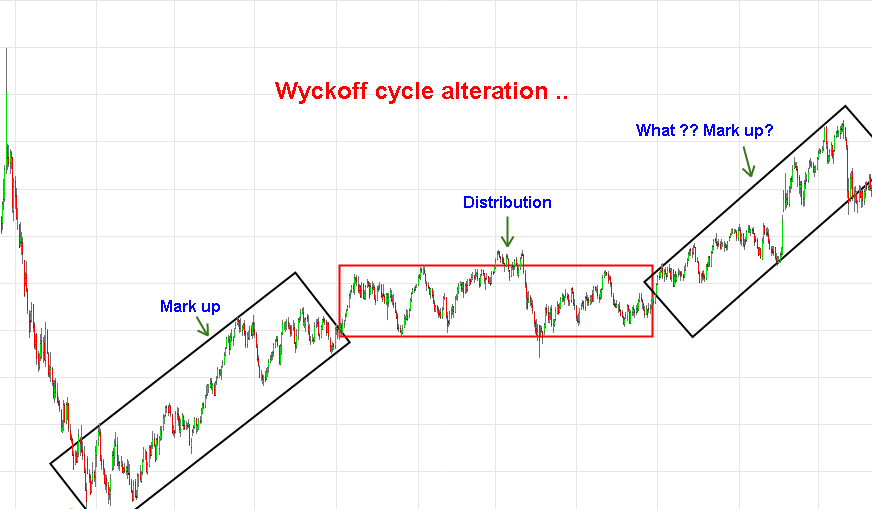

4.Another important fact is, the cycle doesn’t always follow the order like Accumulation –> Mark Up –> Distribution –> Mark Down

It can also be random like, Accumulation –> Mark Down –> Mark Up etc.

Despite all these drawbacks, Wyckoff trading cycle is a great frame work for analyzing and understanding the Market behavior. In my experience, one cannot just rely upon Wyckoff cycle or Richard Wyckoff’s techniques, its necessary to combine them with solid strategies such as Price Action and Market Dynamics In conclusion, the practical applicability of Richard Wyckoff Trading cycle is limited in the modern markets. Nonetheless, it’s still a powerful framework for a trader who knows how to use it.