In stock market, experience speaks louder than anything else, whether it’s profit or degrees. Profits can be skewed without any practical knowledge; Without Practical Knowledge, one cannot trade successfully when the markets are volatile. Experienced traders are into the business for the longer time period with stable profit margins and that’s what counts when you are in stock market for earning your bread and butter.

If you are a budding trader, then these rules of trading from most experienced traders can help you survive during rough times in the market. If you’re a seasoned trader, then these rules may give some new perspective.

Rule #1: Trading Capital Must Be Safeguarded

The most important rule every seasoned trader follows. If your intention is successful trading then you must protect your trading capital.

By safeguarding capital mean – to use it wisely, you must invest when you feel the trade is right and best. Take position when it is necessary according to you and your trading strategy and exit trades quickly especially the ones can leave you in losses.

If you want huge profits at one go, then you are gambling and being irresponsible about your trading capital. In such situation, you have no regards for protecting your capital.

“The most important rule of trading is to play great defense, not great offense.”

…Paul Tudor Jones

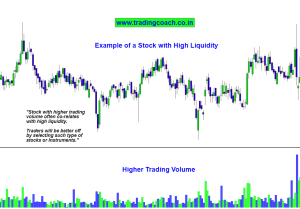

Rule #2: Volume Climaxes Are Important

Exiting the markets during high volume has always proved great for traders. For example, you can definitely reap profits – if you exit a short position, when there is sudden fall in asset prices combined with huge volume.

You must always look out for climatic volume. The highest volume price action is always sensitive to the market psychology.

How to know when the market is in climatic volume? By using Richard Wyckoff method, I cover that in my premium trading course.

“Big volume kills moves. Climax blow-offs take both buyers and sellers out of the market and lead to sideways action.”

…Alan Farley

Rule #3: Never have “Getting Money Back” Mindset

It is common with traders who think about making profit on every single trade they do. When they lose money, they feel the urge to get the money back by taking more positions, which in most cases result in string of losses.

With “getting money back” attitude, no trader can trade with consistency, hence incurs more losses. One example of this mindset is having higher profit expectation which is not at all in sync with market returns and this is the case when trader wants to recover his earlier losses.

It is recommended to change this kind of mindset even if you are an experienced trader with a trading edge.

“When sharp losses in equity are experienced, take time off. Close all trades and stop trading for several days. The mind can play games with itself following sharp, quick losses. The urge ‘to get the money back’ is extreme, and should not be given into.”

…Richard Rhodes

Rule #4: Trade When You Are Sure

Trading edge comes from navigating the market in bullish as well as bearish sentiment. You must not trade when you don’t have that edge.

The bull market is when the market is rising and you can have an edge if you are looking to buy stocks. The market is bearish when it is falling. You can have a trading edge if you are about to sell stocks.You must not trade when the market is uncertain, because you cannot have an edge in such a kind of market conditions.

You are a trader, trade only when there are opportunities

“Do not trade every day of every year. Trade only when the market is clearly bullish or bearish. Trade in the direction of the general market. If it’s rising you should be long, if it’s falling you should be short.”

…Jesse Livermore

Rule #5: Don’t Lose Your Mental Peace

Your mental peace is an important factor for your trading success and you must protect it as you protect your trading capital. It is important just as your trading capital. Be calm and confident, have peace in your heart and mind, be focused and determined when you are trading. You cannot trade with fear and doubt.

If you lose your financial capital you may work and get it back, but what about your mental capital? If you lose it, you cannot get it back easily. You might fall into vicious cycle and your mind will make way to more fear and doubts.

Just follow your trading, take care of your mental peace and happiness. Focus on the process; everything will happen correctly.

“Mental capital is just as important as financial capital. Protect both.”

…Adam Grimes

The above-mentioned five rules can help you find consistency in your trading strategy. It is important to follow these trading rules once you set them. The most important and reliable rules are the ones which you set by yourself from your experience.