When you start trading, the first thing you ought to look for is consistency. A consistent trading performance enables you to earn stable returns. No one wants to lose money day after day! But trading Markets with proper risk management and strategy is not as easy as it seems. Just A simple emotional mistake can make weeks of effort – stable returns vanish in no time. Therefore a Stable trading routine and Performance is necessary – often preached by seasoned traders.

Is there any standard process to achieve Consistency in our trading?

Trading strategies differ according to an individual’s preference, so is consistency in trading. Some play by rules, some create their own rules. Trades or trading systems that are a result of an impulsive or emotional decision can do more harm than good. That’s why it’s suggested that traders should choose a strategy which suits them best by understanding its advantages, and disadvantages. Once you have a sound trading strategy, three simple steps can help you achieve consistency.

Step One: Incorporate Consistency in your Mindset and Approach

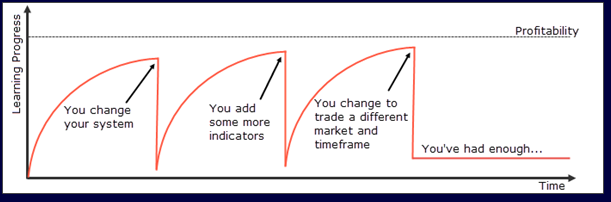

It’s pretty simple. Stay consistent in your approach. Changing strategies and routine without any proper reason is going to leave you stranded. Therefore, opt for a single strategy and routine (which has good probability and R: R) then commit to it. Consistently following a systematic approach helps you develop that habit similar to working out every day. It tends to become a part of you. Consistency in risk management and consistency in tracking your trades enable you to analyze what works for you over long run.

Step Two: Know the limitation of indicators.

Indicators are the most misunderstood tools in technical analysis. You observe an Indicator that’s tracking price very well and develop an anticipation that it works. So you start applying it without understanding how it functions. When Market evolves, chosen Indicator may not work as per your expectation. So what do you do in such situations? Likely you seek other Indicators or trading systems – repeat the cycle again. Instead know the limitations of indicators you choose, try to understand its mathematical calculations before you implement them in live market. Alternatively develop your skills in Chart reading! Reading charts with pure price action undoubtedly gives you an edge in the market.

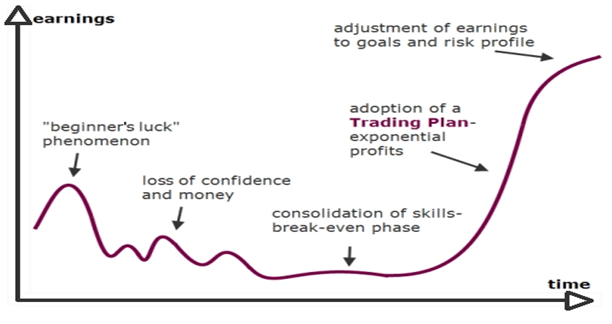

Step Three: Practice makes a man perfect

Many Traders tend to underestimate the necessity of Informative learning. Therefore, early losses harm their self confidence and make them believe that trading isn’t their cup of tea. Nevertheless, this is far from truth. Trading demands practice and learning. A short-term course in trading from Professional Mentors, intense research and knowledge in risk management strategies such hedging and pooling helps a trader to minimize losses. With a Regular practice of chart reading and proper knowledge can keep trader in the right track.

Trading isn’t that difficult, it’s pretty simple but need proper dedication to succeed. If done right it can make you financially independent. Besides overcoming psychological barriers of greed and fear, it is important to maintain self – confidence despite ups and downs. Leaving everything to chance and panicking at consistent losses are not signs of good trader. In conclusion, Mindset, Practice, Experience and Knowledge will lead to consistency in trading.