Price action is an imperfectly defined subject. There are many traders who believe that price action is something complex that cannot be quantified. To other traders, trading price action means trading the patterns of price bars on charts, without the addition of indicators or other lines. But for me, price action simply means how markets usually move.

Price action is the term used to describe the market’s movements in a dynamic state. Price action creates market structure, which is the static record of how prices moved in the past. Think about a finger tracing a line in the sand. Market structure is the line left in the sand; price action describes the real movements of the finger as it drew the line. In the case of a finger, we would talk about smooth or jerky, fast or slow, and lightly or with deep pressure into the sand. In the case of actual price action, we would look at elements such as: How does the market react after a large movement in one direction? If aggressive sellers are pressing the market lower, what happens when they relax their selling pressure? Does the market bounce back quickly, indicating that buyers are potentially interested in these depressed prices, or does it sit quietly, resting at lower levels? How rapidly are new orders coming into the market? Is trading one-directional, or is there more two-way, back-and-forth trading? Different factors combine to describe how the market moves in response to liquidity. This is what we refer as Price action. Read about Market structure here..

HOW PRACTICAL IS PRICE ACTION TRADING ?

Let me answer this with a demonstration:

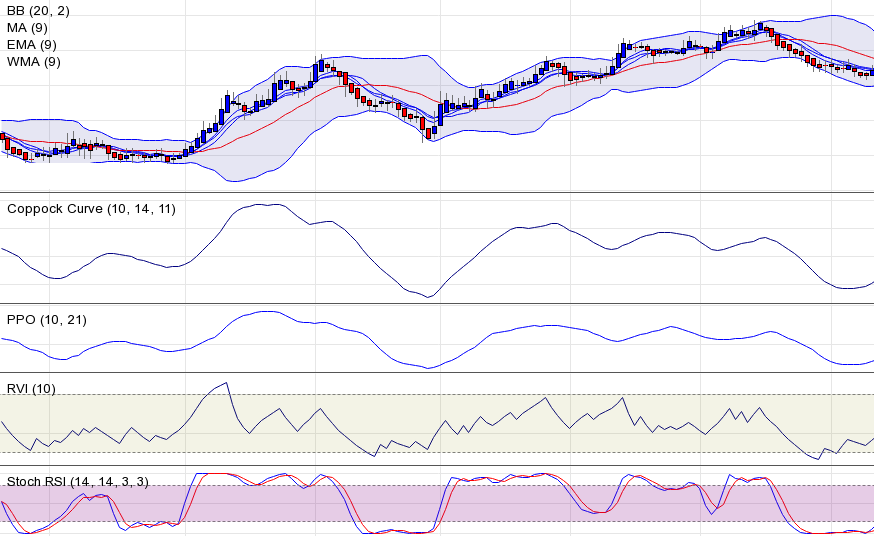

Observe the nifty chart, loaded with technical indicators. Consider a few essential questions about market action, which are very important for traders. Can you see current market price in this chart? What does this chart tells us about the present market conditions? How Market is reacting at Key levels? What Market participants are thinking? Which emotion is in play right now? Greed or fear? What is the direction of the market trend? Whether the trend will continue or will it end? Markets are confusing enough in their natural state; some of the analytical frameworks traders use adds much to the confusion. The productivity of price chart is to extract important information from the market, but adding indicators like this will lead to irrationality and confusion. Simplicity is often better than complexity. A chart is nothing more than a tool to display market data in a structured format. Once traders learn to read the message of the market, they can understand the psychological tone and the balance of buying and selling pressure at any point.

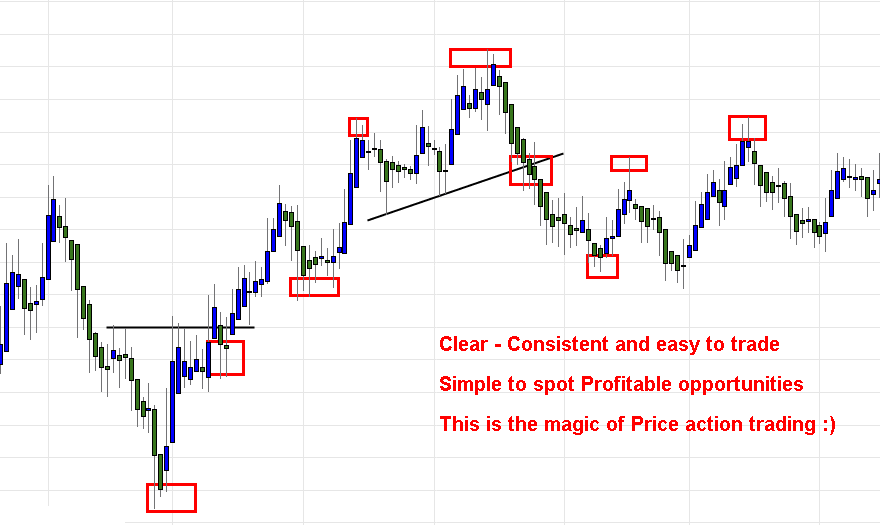

Now consider this chart, By looking at the chart above- It’s obvious to spot market trend, Open – close, Highs and lows, Current market price and important support and resistance levels. Clean charts put the focus where it belongs: on the price bars and the developing market structure. Tools that highlight and emphasize the underlying market’s structure are good; anything that detracts from that focus is bad. When you see a chart, you want the price bars (or candles) as the first and most important thing your eye should be drawn to; any calculated measure is only a supplement or an enhancement. Understanding Market pressure is the fundamental edge for technical trader.

WHO USES PRICE ACTION TRADING ?

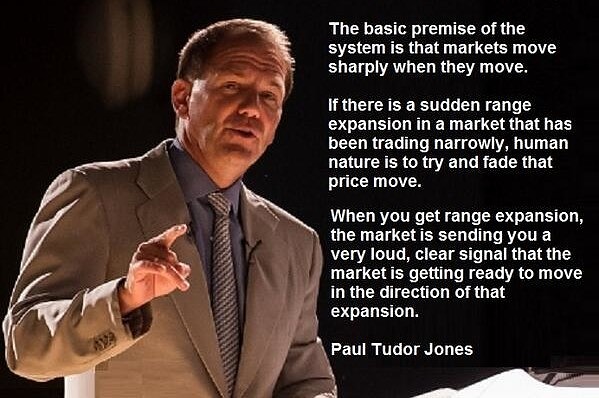

Price action trading is an approach to practical trading and it’s the way of profitable traders, it is used by large-scale prop traders and even portfolio management firms. Every successful and experienced retail traders will use price action to some extent. Even floor traders and algorithmic traders use price action trading as the foundational trading strategy. Some of the competent traders such as Paul Tudor Jones, Richard Wyckoff, Jesse Livermore, James Keene and Victor Sperandeo – all were price action traders; they defined their own trading methodologies based on price action. Tape reading is a method of Price action trading. Tape readers in essence are also price action traders.

Read about Paul Tudor Jones here …

You can apply price action trading on any time frames, whether its 5m chart or Weekly chart. Whether you’re an intraday trader or swing trader or Positional trader – you can adopt price action trading as your core method. Price action trading can be applied to all markets such as commodities, forex, stocks, futures and options.

Any one can be a price action trader, like merchandise business price action trading is a skill, which can be learned and mastered. It’s the path one has to choose, to be a successful trader.