After experiencing a major crash and unprecedented Volatility, Stock market seems to be stabilizing slowly now. Govt measures, interest rate cuts and Fiscal stimulus packages might have revived the Investor confidence across Global markets, as certain group of people seems to be convinced that market has indeed found the bottom.

But some prominent investors and professional traders are begging to differ. They have another name or explanation for the rallies we are witnessing right now – Bear Market Rally or to be very precise, Bear Market Traps.

What is a Bear Market Rally?

Bear Market rally refers to a sharp short-term increase in Stock prices within the long-term bear market period. Uninformed Investors and traders can misinterpret the Bear market rallies as the sign of Market Bottom or as the end of Bear Market. This type of Price Action is also known as Sucker’s Rally or Bear Market traps. In Bear market rallies, Stock prices appreciate quickly in value over short-term before heading onto new lows.

To get a better sense and understand whether the recent move is a Bear Market Rally or not, I analysed the Price Action of 3 different Stock Indexes. Even though we can’t precisely predict what will happen, the combination of Price Action and Intermarket Analysis will give an Informed Insight.

Cross-checking the Price Action of Stock Market with Intermarket Relationship

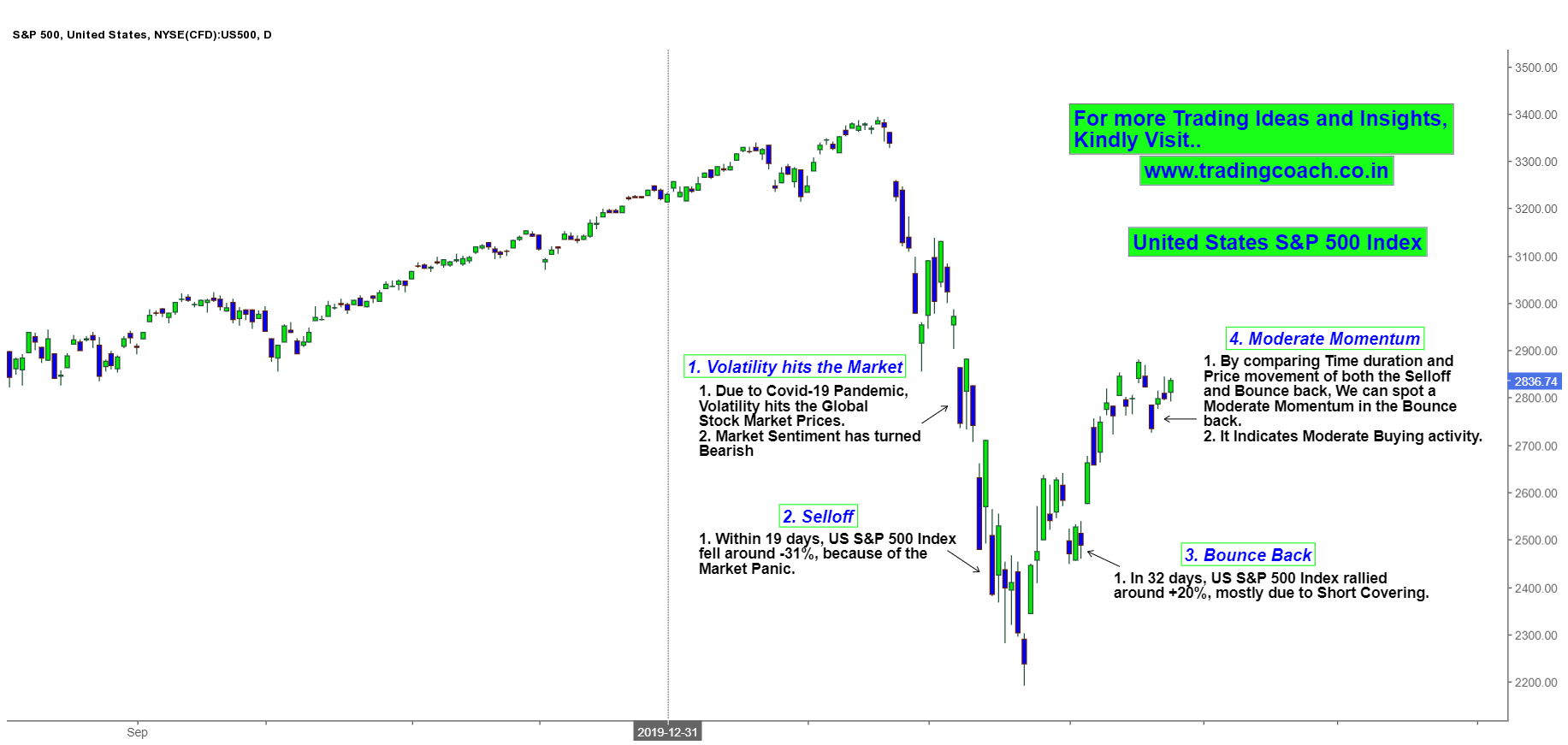

As you can see, all 3 Stock Indexes from different countries are exhibiting similar price behavior. Large and dramatic fall followed by Short term rallies. The so-called Short term rallies also known as “Bounce back”, needs a closer examination to clarify whether it’s a beginning of a new uptrend or just another Bear Market Rally.

First and foremost, possibly these rallies could be a result of “Short Covering”. Market Participants who may have taken Bearish positions in the previous downfall could be squaring off their trades, as a result prices might be moving higher. There could be some buying interest but mostly it’s either small or due to uninformed investors.

Another important factor is “Momentum” – In all 3 Stock Indexes, the Momentum behind the Bounce back rallies are moderate or weaker than the selloffs. The time duration of the Bounce backs are also slower than selloffs. Going by Momentum alone, we can understand that Buying Pressure is relatively weaker than the Selling pressure. In order for Stock prices to turn into a new uptrend, we need to see a strong increase in buying pressure.

Based on these two factors, I am convinced that Market has not yet reached a bottom point. There are good chances that present rally might turn out to be a Bear market trap – either stock prices could move sideways or fall towards new lows. Of course, my assumption could be wrong! But for Market sentiment to change, we need see more evidence either through Price Action or through fundamental shifts. Neither of them is convincing enough now.

It’s better to wait for more clarity rather than taking decisions impulsively. We need to watch price action in coming days and take trades only if there’s a proper setup with favorable risk – reward.