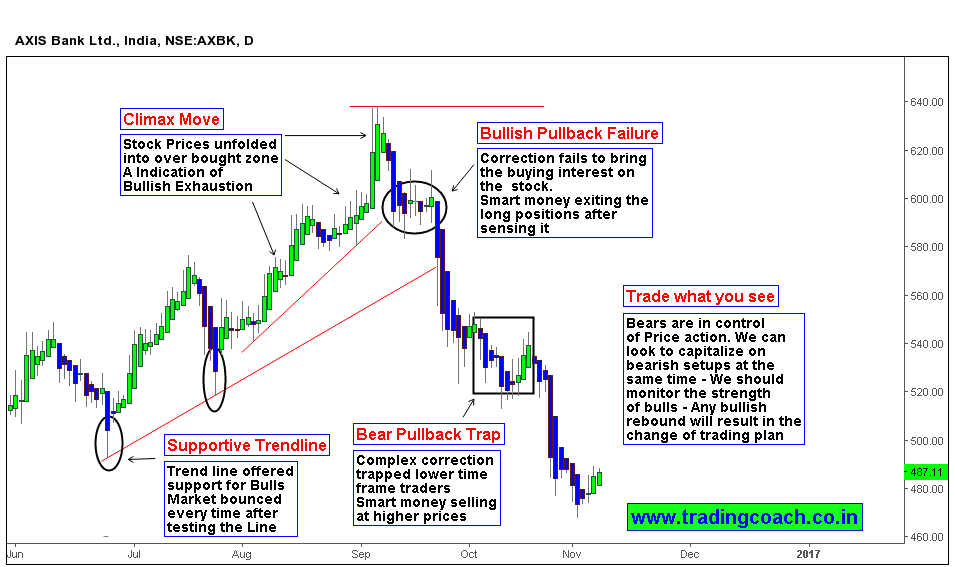

Axis Bank share prices are selling off from the beginning of September and I have written multiple articles tracking on the stock based on each development. To highlight the current market structure, I have used Heiken ashi candles (which is highly helpful for reading Price action with the absence of noisy fluctuations). In this content let me address an important issue bothering those who invested in Axis Bank. Are the share prices in correction mode or is it a Bear market ? .

Bear Market should not be confused with correction; in a technical sense the definition of bear market is a downturn of more than 20% from the peak in a period of more than two months. Correction is a short-term trend with duration of two months. Given the fact Axis bank share prices fell from 640.00 to 480.00 over the period of past two months with a rate of 23%, it stands between the standard definition of bear market and correction. Based on percentage we can term it as a bear market, but taking the time period of two months into consideration it stays in the boundary of correction.

November holds the key for confirmation, Development of Axis Bank Price action over the month can shed light over this paradox. If we see consistent sell off in the period of November then Axis bank is officially in a bear market or if not then vice versa. Traders can look to capitalize on bearish trading setups also keep an eye on any bullish momentum. Eventually traders can do either trend trading or counter trend trading depending on the development of Price action.