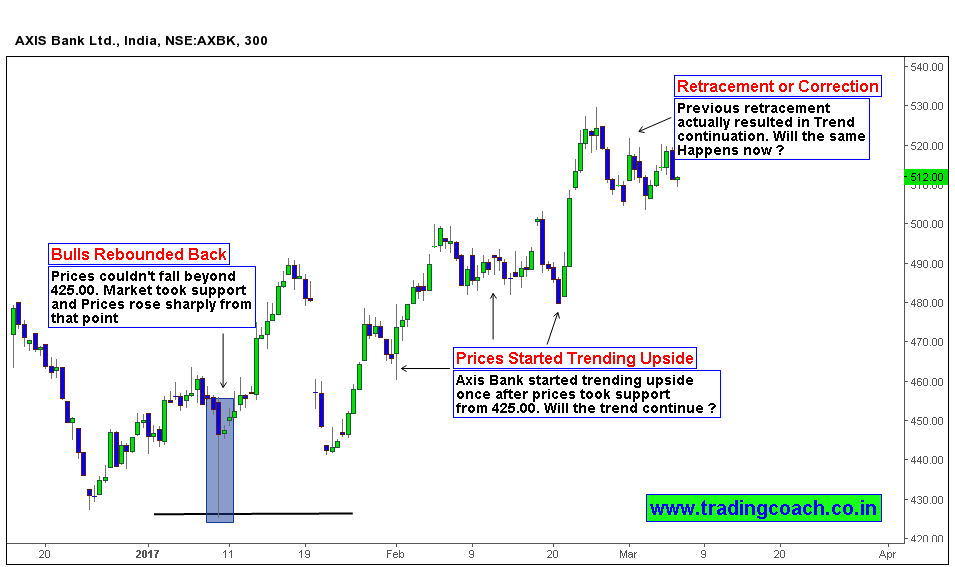

Axis Bank share prices are making higher highs. We are seeing a correction or retracement above 500.00 (a notable psychological round number and key level). Well previous retracements which tested the trend resulted in trend continuation – Will the same happens this time?

Since the beginning of this year, Investors are quite optimistic on this stock (within the banking sector.) With low PE and better prospects of Future valuation, Axis bank seems a best choice from the perspective of Fundamental Investing. Price action reflected this optimistic sentiment, by taking support at 425.00 in Mid January. Bulls rejoiced and prices rose sharply from that point.

Consequently, AXBK trended upside for last 2 -3 months. (Short term trend as per Dow Theory) Within the Trend structure, there were multiple corrections and retracements tested the conviction of Bulls. The trend is still intact despite multiple resistive forces.

Now, if the trend continues, we can conclude that, a new uptrend is in place. Incase of any selloff or reversals then structure can change with high volatility. I will be looking for a long trade, but if I spot any changes in the Price action then my trading plan will change.