China, the largest crude oil importer in the world is starting their domestic oil futures market very soon after years of planning. The Shanghai International Energy Exchange (INE) is anticipated to launch the oil futures trading during Jan 2018 after it got the approval from the China Securities Regulatory Commission this week.

Impact on US Dollar

Since INE is registered in the Shanghai’s free trade zone, they will also allow foreign traders to invest and that can adversely impact the strong role played by US dollar in the oil market so far. This will be first Chinese oil futures contract based on their local currency Yuan which can disrupt the Trillion-dollar global oil market that has been dominated so far by the exchanges in New York and London. Until now, the U.S West Texas Intermediate and the London’s Brent have been the popular crude benchmarks but with China starting their own domestic oil futures, a third benchmark will come into play.

Advantages of Yuan-based oil futures for China

The domestic oil futures contract would help China to regain some control over determining international crude prices and also increase the role of Yuan as an international currency. This will also help in achieving their long-term goal to dethrone the dollar. China will also gain some advantage by having a new benchmark based on grades of oil consumed mostly by the local refineries which differ from the WTI and Brent benchmarks. It will help Chinese President Xi Jinping’s initiative of ‘One Belt, One Road’ to develop ties across Eurasia and the Middle East. It will also help China to enforce the global macroeconomic policy and achieve self-sufficiency.

Changes in the global oil market

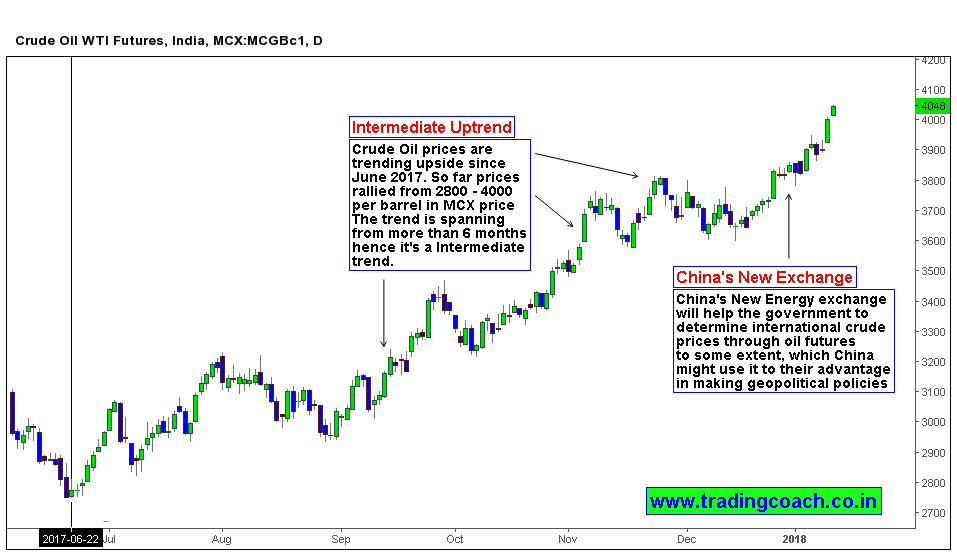

With China starting their Yuan-based oil futures contracts, it will allow international traders to arbitrage between the three different exchanges. Since China is also the biggest consumer of Crude, it can have a significant impact on the global oil prices going forward.

For example, Nickel was launched as a commodity futures market in Chinese exchange back in 2015 and it outpaced the trading volumes of London Metal Exchange within just 2 months. Similarly, Yuan-based oil futures contract can also become a tough competitor for the western-dominated oil futures market. China aims to reduce the global oil prices for their advantage through the domestic futures. It can also lead to further volatility in the global oil prices since speculators will take advantage of the price differences between various exchanges. A major oil merchant stated that initially, traders might use it as a Arbitrage play between the Yuan and dollar.

Since it has been a long-term practice of paying for oil in dollars, it might take some time for international investors to get accustomed with Yuan-based trading. They are also concerned about the additional risks such as the dominance of the Chinese central government and favoritism towards Chinese conglomerates. With such a dramatic shift in fundamental factors influencing Oil prices, Crude oil traders must pay attention to Chinese activity as well.