Copper has fallen in recent days due to mixed economic reports and Chinese efforts to curb speculation. Price action is inline with broader commodities and investors are cautious to pull the trigger. Current price value of copper is 2.115.

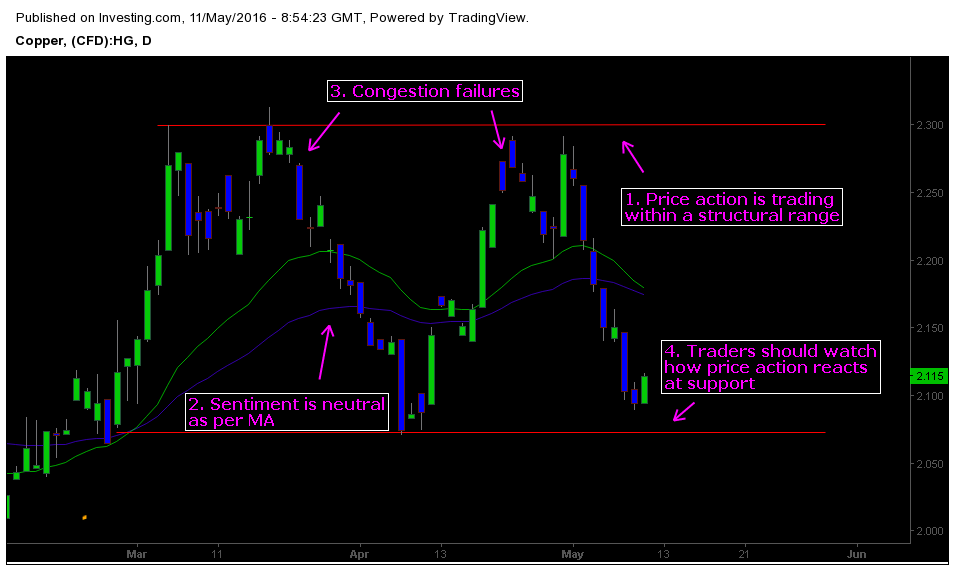

Below is the daily chart of Copper with price action analysis.

1. Price action is trading in a structural Range.

Copper is trading in a broad range between 2.300 and 2.075. Market is oscillating in a random fashion confusing both long-term investors and short-term traders. Even in lower time frame, randomness is dominating the Market structure.

2. MA indicates the uncertain market sentiment.

MA is a reliable indicator to measure the market sentiment. Price action is randomly acting between Moving averages. 25 periods and 50 periods MA indicates that market sentiment is uncertain. Recent Price action confirms the thesis as investors are cautious due to global economic environment.

3. Congestion Failures signals the liquidity traps.

Congestion failures show the structural traps and liquidity factors that are affecting price action. We should take calculated risks before trading or positioning within the range. Congestion near the resistance level 2.300 shows the failure of buyers to push above the level. Another retest at resistance can give a better gauge on market sentiment.

4. Traders should watch the price action at 2.060 – 2.075.

Traders should see how price action reacts at support level to get a better understanding of market structure. Price action can offer opportunities and trading setups but traders should measure risk before getting into any trades. Market structure can affect the probability of trading setups. Also keep an eye on fundamental reports.