Indian economy and stock market was vulnerable to economic dislocation ever since the reforms and laws of the new Modi Government have come into effect. With the effect of sudden demonetization, the economic growth rate has shown a severe imbalance. GDP growth has shown a sudden decline from 7.9 % in April-June 2016 to 7.5%, 7 %, to all-time low 5.7 % in the subsequent quarters of 2017. To overcome the situation of this lagging economic growth, Modi government has planned an economic package to stimulate growth. The stimulus package will improvise scenarios existing in the domain of power, housing, and social welfare programs. The agendas are aimed at employment generation opportunities and skill development measures.

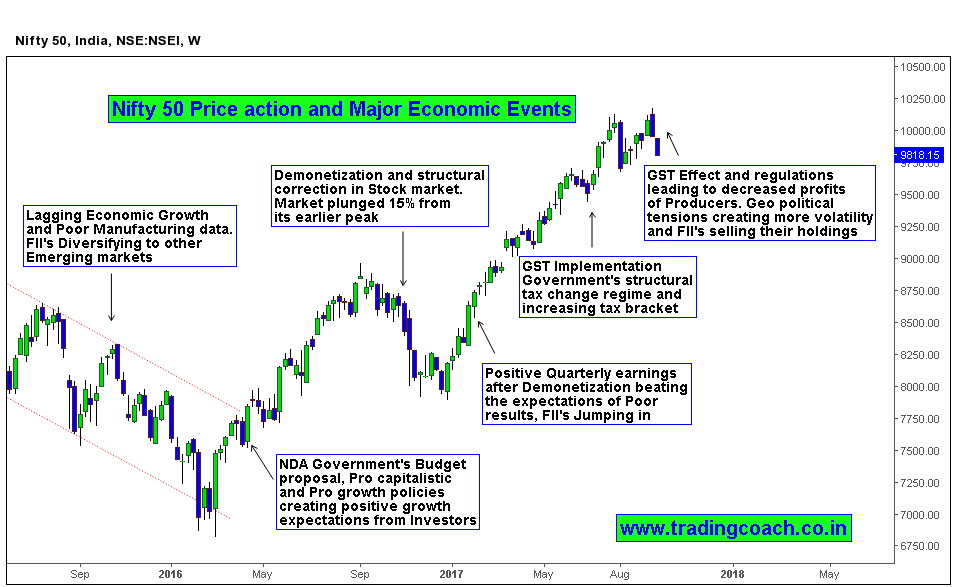

Stock Market Index (Nifty50) Price action and Economic Events Timeline

Some Key Points in economy package

1. Economic package has been pegged at approximately 50,000 crores

2. The government has been aiming for a 24 hours supply of electricity for all major urban and rural locations by the financial year 2019

3. Special emphasis will be laid for the betterment of under privileged class, so to remove the barrier of low- class and high-class

4. Employment generation programs have found a high spot in the economic package

5. Improvising on revenue from exports, domestic investment, and growth of small and medium enterprises

6. Home for all – an idea that aims to stimulate low-cost rural infrastructure and affordable housing projects

Effect of new policy on stock market

The stock market was significantly affected by lagging economic growth. The vision or agenda of new economy policy is to increase fiscal deficit to improve public spending, Privatization and consumption. In other words, Government is planning for Expansive fiscal policy to stimulate economic growth. As of now, the stock market traders and investors hoping to regain the losses incurred in the past few months. Whether Market views it in a positive or negative tone could only be said once the package is implemented. In my perspective, it’s good for stock market, gives another reason for typical bull market to continue over long-term. But will not do much to reverse short-term correction.

What Investors and Traders should do?

Economic stimulus is primarily aimed at stimulating growth so traders and Investors should focus on sectors which are likely to benefit from the government policies. Some sectors that are likely to benefit are:

Infrastructure

Iron and Steel

Power

Consumer Durables

Realty

Capital Goods

Construction Materials

Once we come up with a list of sectors,then we need pick Stocks within the sectors using Relative strength concept. We can later build Intermediate and Long term positions in them using Price action Analysis and Setups. Combining Macro themes with stock picking and Price action can give an excellent edge for swing traders, Positional traders and even Investors.