Richard Wyckoff method of profiting from the stock market using technical analysis and relative price strength has stood the test of over 80 years was taught by Richard DeMille Wyckoff in the beginning in 1931. Wyckoff described many important aspects of the stock market in a book titled Studies in Tape Reading. His observations are still valid today.

Richard Wyckoff believed most strongly that stock prices were determined solely by “supply and demand.” He had little use for tips, rumors, news items, earnings analyses, financial reports, dividend rates, and the myriad of other sources of information. He was a true technical analyst, and a very successful one. He believed that the markets were influenced mostly by wealthy individuals and informed insiders. Substituting “institutions” today for these players, we find that the situation has not changed. By understanding what these capital pools were doing in the markets, one could profit by following them. Their capital moved the markets, whether right or wrong. Read about the background of Richard wyckoff here..

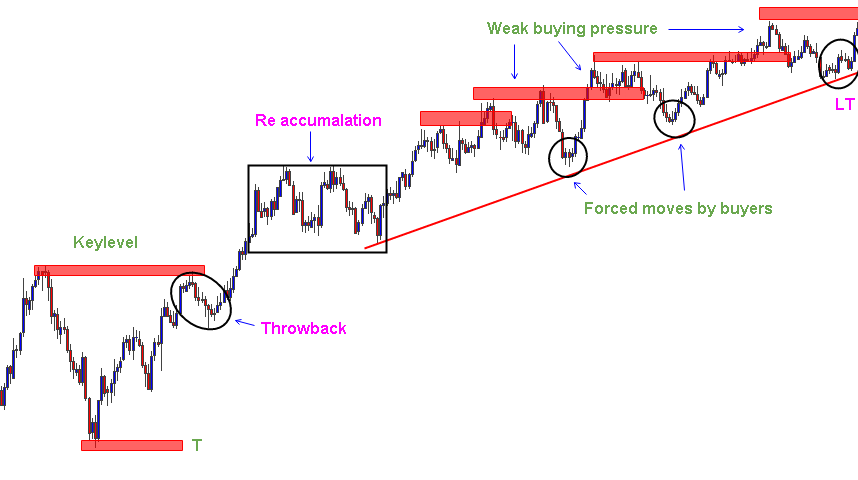

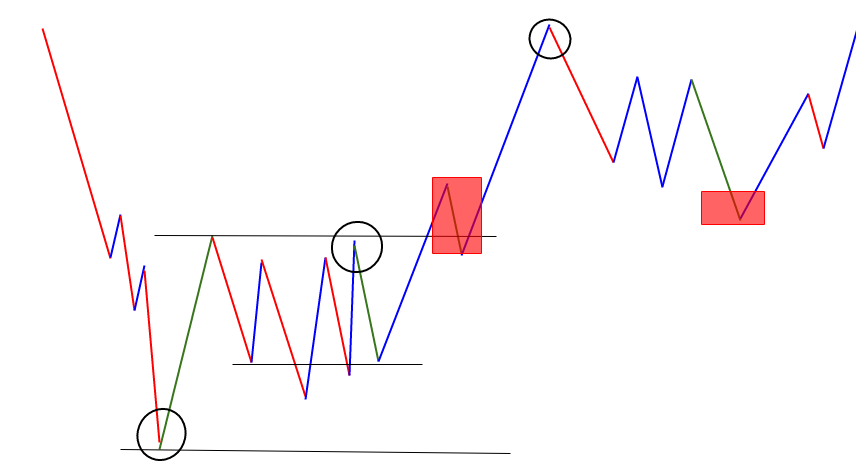

The price action, he believed, traveled in waves, small ones evolving into larger ones in either direction— or that these waves could be detected and even anticipated, but they followed no certain, mathematical path. Consequently, although his method had some organization, it required judgment and experience.

Richard Wyckoff Method of selecting stocks

Wyckoff’s progression of selecting stocks was as follows:

1. To determine the direction of market, Richard Wyckoff devised an index called the Wyckoff wave that was a composite of the most widely held and active stocks. This was his proxy for the market. Preferably, the stocks in the index were the ones that the investor or trader interested in trading. His concept of trend was to watch trend lines drawn on the Wave chart and on charts of the composite market.

2. To select the stocks in harmony with the market, Wyckoff selected stocks that were strong in upward trends and weak in downward trends. He believed that it was futile to act against the trend. His calculation of relative price strength used the percentage changes from wave highs to lows and lows to highs of each stock versus those of the Wyckoff waves. Those stocks that consistently outperformed in each Wave in the direction of the longer Wave trend were the ones to analyze further.

Wyckoff wave is similar to swing analysis…

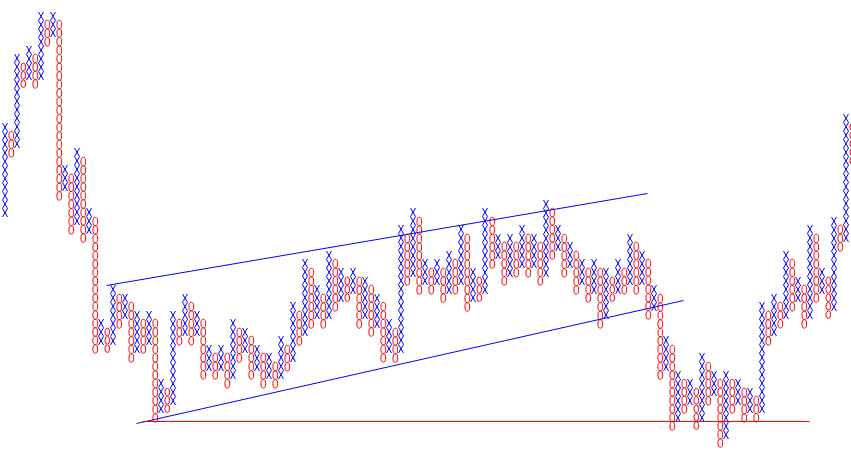

3. To determine the potential of those selected so far, Wyckoff used the point-and-figure horizontal count. At the same time, a stop level was established, and for the stock to be considered further, a three-to-one ratio of potential gain to potential stop loss was necessary.

4. To determine if the stock is ready to move, shorter-term considerations were needed to analyze the nature of its price action. To do this, Richard Wyckoff method relied on volume, range, and to some extent, short-term momentum. This part of his method relied heavily on experience and judgment.

5. To time the entry, Wyckoff based his decision on the turning in the overall market. His basis for this principle was that most stocks move with the market direction, and to time with the market change just reduces the risk of error.

My Modification of Richard wyckoff method

I have made several changes on the original Richard wyckoff method. Say, for example, I use Index Price Movements instead of Richard Wyckoff’s wave chart. But nonetheless, basic foundation of my trading strategy is derived from Wyckoff’s trading style. Wyckoff’s tools were many of the methods described in this book. He used bar charts (called “vertical charts”) and point-and-figure charts. He measured relative strength for both long and short positions, used volume to test the best time to consider acting, required stop orders be entered with any action order, used trend lines to determine direction, used composite indexes, used group indexes, and believed that timing of entry and exit was the most important variable in success. Some his techniques may not work today, due to the domination of algorithms and High frequency trading, but however his stock selection is standing as a test of time. Being a price action trader; we need to pay tribute for this legend, Richard Wyckoff.