If you’re looking to take some positions in the FMCG Segment, here’s a good Price Action setup on one of the less popular, small cap FMCG stocks.

Heritage Foods, which goes by the Ticker symbol NSE: HERITGFOOD, is one of largest diary companies in South India.

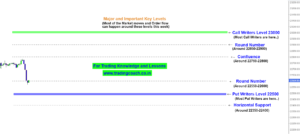

Take a look at the Price Action of the Stock in a higher time frame.

Heritage Foods – Price Action trading Analysis on 1D Chart

Overall, stock prices have been trading in a Structural range since Mid-October and prices have formed a strong and formidable resistance zone at 330.

We saw some selling pressure at the resistance in the beginning of the range; later prices clearly broke out from the resistance with strong upside momentum.

Prior to the Breakout, Price action showed some signs of Big Players and Accumulation on the Stock, especially when prices showed squeeze formation at the resistance.

Right now, prices are retesting the support zone to check the conviction of buyers. What’s next? Will stock prices continue to go up from here? Will the retest be successful or will it result in failure?

Keep an eye on the Price action and trade according to the market behavior of the stock. What’s your opinion about this stock? Leave it in the comments!

To learn more about the Retest trading strategy, checkout the video given below.