Higher highs followed by minor correction and sudden rallies (Crowd buyers in rush) – these are the Price action characteristics of Nifty 50 (since March 2017). It defied many analyst calls for overvalued markets and correction. This single instance proves how tough it can be to predict the markets! It’s always a losing proposition, As a Price action trader; we look for trading opportunities that has potential risk: reward, instead of right market prediction (which is always a gambler’s fallacy!)

A Closer look at the Price Action of Nifty 50

Keeping this fact aside and focusing on present moment – This is what we observe in Daily chart of Nifty 50.

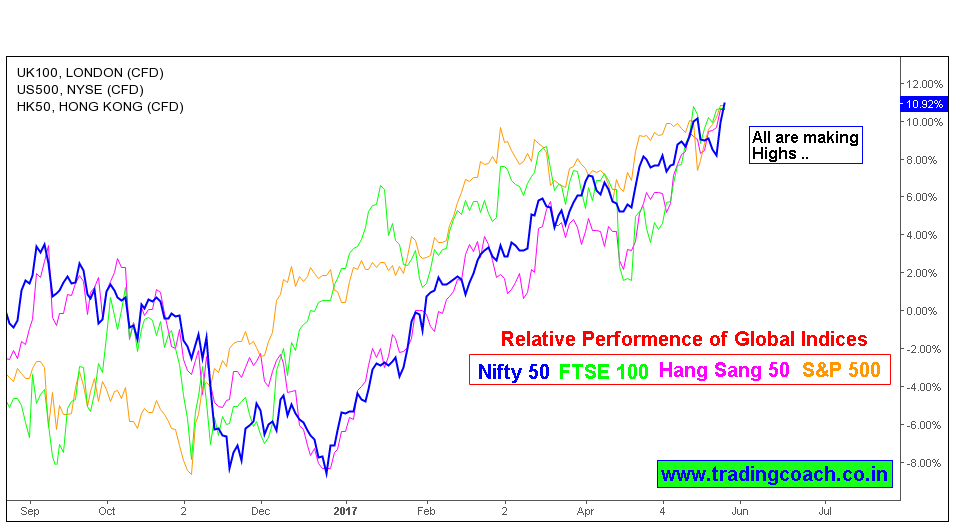

Daily chart is a precise tool to understand the crowd psychology; Price trends are clearly analyzed and evaluated in Daily chart when compared to lower time frame. From Last 5 months, Prices steadily rallied upwards except for minor fluctuations and pullback within the trend. This year was a golden time for Index trend trading, but will it last forever? Remember it’s not just Nifty 50; many indexes across the globe are reaching new highs (such as FTSE 100, S&P 500 etc.)

Relative Performance of Global Stock Markets

All Global stock markets are highly correlated, so a minor selloff or a crash in one will reach other in less than no time!

So knowing this, what a prudent trader must do? Understand the big picture and Trade according to it using commonsense. For example – In the present case scenario, the general condition is Nifty and other Indexes are making new highs and the commonsense is that markets don’t move in a straight line, a correction is a part and parcel of the Market structure.

Remember the general trend trading adage? “Trend is your friend until it bends” Let’s use the same tactic here! Trade the trend, but be flexible to bet against the trend when it terminates.

Higher the prices can go, sharper the correction will be, Knowing that predicting markets is a losing proposition and sticking with my Price action trader’s manifesto (“Trade what you see”), I will take less risk on Trend trading setups and bet more if I see a trend reversal pattern. Remember successful trading is not about prediction, but capturing good trades!