Nifty remained in 100 points throughout the week, as Investors look forward for FOMC decisions and GST Bill legislation to break from the ranging market structure. Around the close of this week BSE sensex was up 92.72 points at 27803.24, Nifty gained 31.10 points at 8541.10. Price action ended flat for the week compared with 2.6% rally over previous week. Nifty closed at 8541.20. Banking sector continued to see selling pressure after disappointing results. Biocon become best gainer for the week.

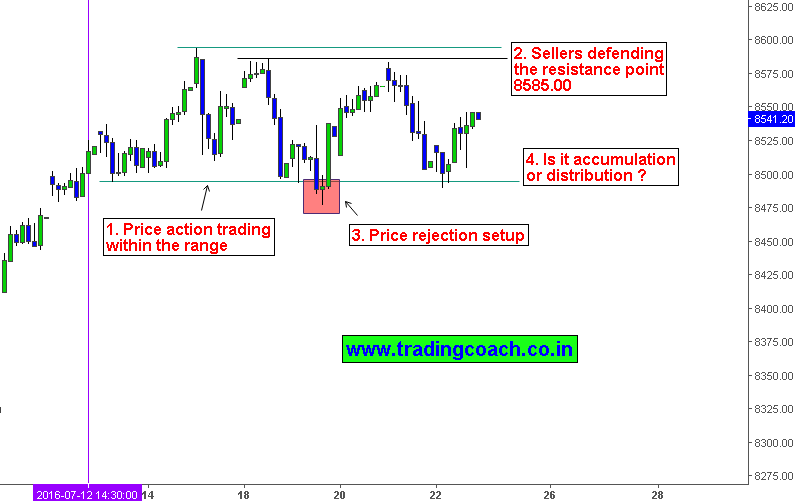

Nifty 1h chart for Price action trading

1. Prices are trading within 100 points ranging structure between 8495 – 8593. Market formed high at 8600 and low at 8500. Through analysis we note that prices consist of symmetrical price swings, creating a paradoxical confusion to decide whether markets are in accumulation or distribution phase.

2. Sellers defending the resistance zone between 8575-8585. Selling pressure is most likely a result of position adjustments and profit taking ahead of GST legislation results. Traders should observe the strength of selling pressure at key resistance levels.

3. We spot a price rejection setup around 19th July. It’s a sign of classic Wyckoff springs. Price action trading within this range can increase a system’s positive expectancy and trading edge. Stop placement is a daunting task as traders are getting trapped at the bottom.

4. Within the range we see the traits of both accumulation and distribution, so it’s hard to make a firm determination of market sentiment and trading bias. We need to keep an eye on fundamentals such GST legislation, FOMC decisions. Also observe next week’s opening price behavior. Happy trading!