Price action is an imperfectly defined subject. There are many traders who misunderstand price action. Some consider price action as nothing more than candlestick analysis. To other traders, it means trading chart patterns or price bars, without any addition of indicators. For me, Price action is how the market moves, Price action is the fundamental force behind market action. Price action tells the story behind each price bar. Price action is not a trading system; it’s a trading skill cultivated through practice and experience. We can read market action on a bar by bar basis, on a tick by tick basis. Price action is the successor of Tape reading. In its purest form, price action is the Behavioral analysis of Market psychology.

PRICE ACTION AND MARKET STRUCTURE

Price action can be defined as market’s movement in a dynamic state. Price action produces the market structure. Market structure is a record on how price action reacted in the past. We read price action through the market structure. Remember, Price action means understanding market psychology behind the market structure, as it is produced by the price moment.

While analyzing Price action, we will look at attributes and consider questions such as……….

How market reacted after a large moment in one direction? Are sellers more aggressive or buyers more aggressive? What happens when buying pressure relaxes? How market reacted after testing the support level? Where is the resistance level, how price will react?

Evaluating market structure is similar to the process of scientific observation. Normally a Price action trader needs persistence and patience in understanding the natural state of market psychology.

PRICE ACTION TRADING IS NOT PATTERN TRADING

Market moments are usually random; patterns that markets create are also random. A true Price action trader wouldn’t bother about any patterns. He is consistently looking at less than random spots for profitable trading opportunities. Understanding the market psychology behind these random price moments is the key to harness “trading edge”. Reading market psychology behind these random moments will provide us with contextual patterns, where we can quantify our trading opportunities. Logically speaking, Price action trader is not trading the patterns; rather, we are trading market psychology behind the patterns. We are betting on the odds of market psychology, not the random market moments.

EQUILIBRIUM AND ANTI EQUILIBRIUM

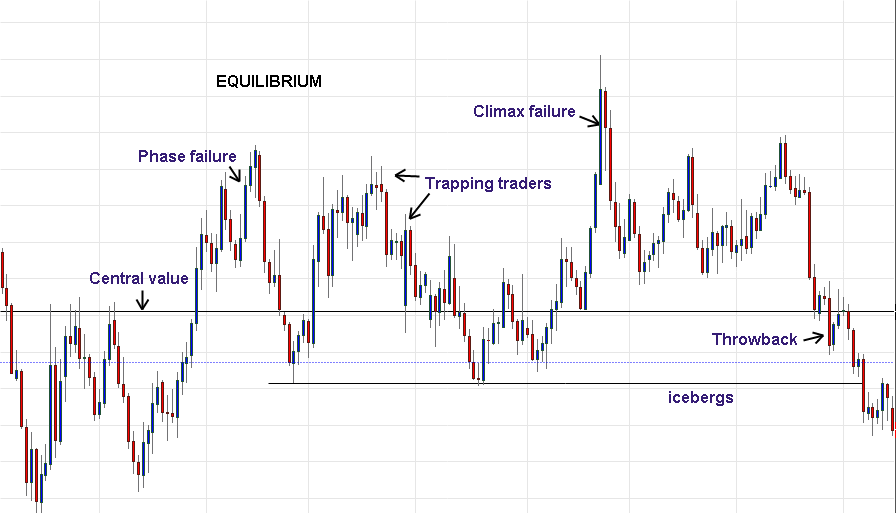

EQUILIBRIUM

Financial markets are usually in the state of equilibrium. Buyers and sellers have no sharp disagreement over price value. Market prices drifts around a central value, this is expressed in price action as large or small random structures. Market action around volatile ranges can be statistically close to random walk model. Technical traders should avoid this kind of market structure, because, we can’t have any trading edge in these circumstances.

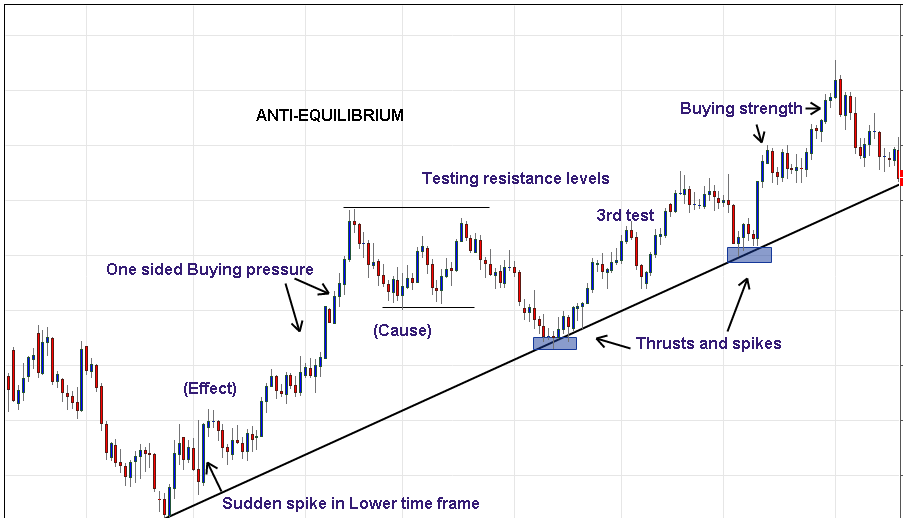

ANTI EQUILIBRIUM

Eventually there will be a liquidity failure in the Equilibrium. Price makes a sudden and impulsive moment in one direction; there are multiple reasons for phase transitions from equilibrium to anti-equilibrium. Psychologically, market participants might view this large moment as temporary distortion which pushes the price action back to the equilibrium. Another possibility is that, impulsive moment will lead to a break of equilibrium and develops into a feedback loop. Price action will express this as a new trend formation.

INTERPLAY AND ESSENCE

This interplay between equilibrium and anti equilibrium is the fundamental essence of market structure. It’s root of understanding market action. At any time, we need to find whether market is in equilibrium or anti-equilibrium. Then we need to read the price action from this context, which helps us to track the market psychology. Market psychology offers us with profitable trading opportunities. The patterns we see in the market are reflections of market psychology, they are useful because we can trade them, define risk and quantify them. But remember they’re profitable only if they’re manifestations of market action.

” remember they’re profitable only if they’re manifestations of market action. ” can you throw some light on this last line what exactly this means ?

Hi Ram

Price action patterns are only profitable if they appear in context of market sentiment.

For example if long term trend is bearish, it’s highly probablitical to take setups in the same direction