Investors of this debt free, small cap company’s shares were in for a surprise when their Christmas gifts arrived early in the form of a 300% surge in stock prices in a span of merely 6 months from 221 INR on 21st June to 860 subsequently by November 30th. It’s safe to say the Christmas party has been ushered early and has already started for investors of Saregama India on Dalaal Street and experts believe this is just the tip of an iceberg and another continued surge of upto 40% is projected.

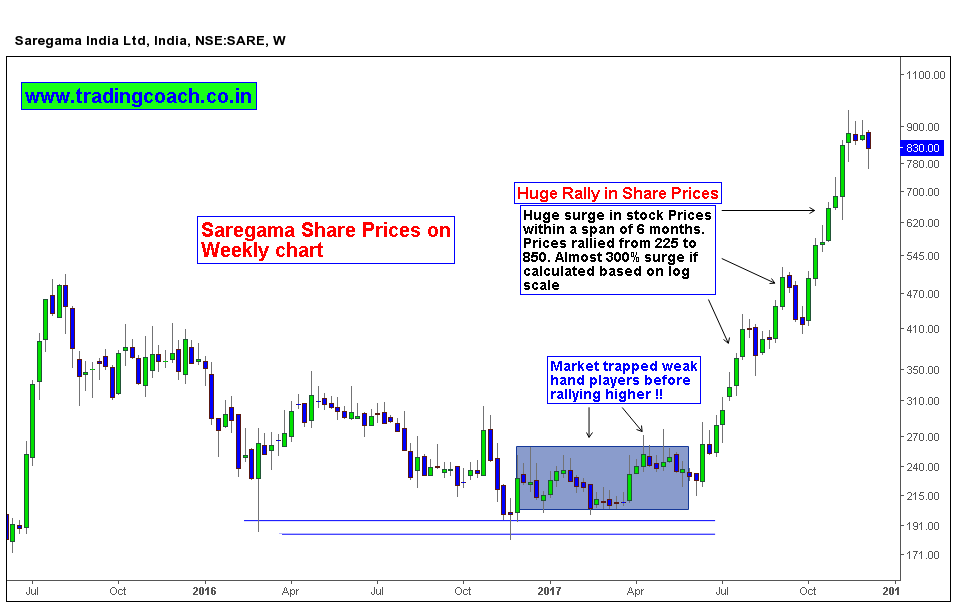

Saregama Price action in Weekly chart show it’s Unprecedented surge in Value

This surge in stock prices is attributed to Saregama India’s strategic transition from a record label to a premier entertainment provider by focusing on business to customer segments and diversifying their product portfolios with alliances with regional film and television content and acquiring intellectual property rights for the same. Moreover in a bid to offer customized solutions to target specific age groups, Saregama has now launched Caravan, a portable digital device with a pre-loaded playlist of more than 5000 classic songs for the 40+ age group. Priced reasonably between 6000 – 6500 INR , the product comes with added connectivity features like Bluetooth and USB facilities and sold more than a lakh units within the first quarter of its launch.

While the company is still contemplating a foray into film production under the banner of Yoodlee Movies, in an attempt to further monetize its music Intellectual property rights, it has created a strategy of captivating audiences and usurping market shares by targeting the business to consumer segment specifically. The Caravan, Saregama India’s flagship digital portable device is a classic example of materializing the same policies. The Caravan is forecast to sell at least 3 lakh units in the forthcoming fiscal and supersede the mark in the next fiscal year with a target of selling 5 lakh units.

Saregama India had posted over 100 per cent year-on-year rise in net profit at Rs 4.46 crore for the quarter ended September 30 which is a significant improvement from its closing figures revealed in the same quarter last year. Net sales of the company jumped 76.33 per cent year-on-year to Rs 84.46 crore in the second quarter of the Fiscal Year 18. With all content gradually going digital, Saregama India is sure to capitalize on an increasing demand for vintage music which it solely reserves all copyrights for and exploiting them through their flagship range of products only, like the Caravan is only likely to keep the curve in progress.

If you’re a positional trader or Investor with long-term holding preferences then better keep this stock on your Watch list. When Price action setups, formations align with the market sentiment and Fundamentals we can expect excellent trading opportunities.