Crude oil Technical analysis

RELATED postS

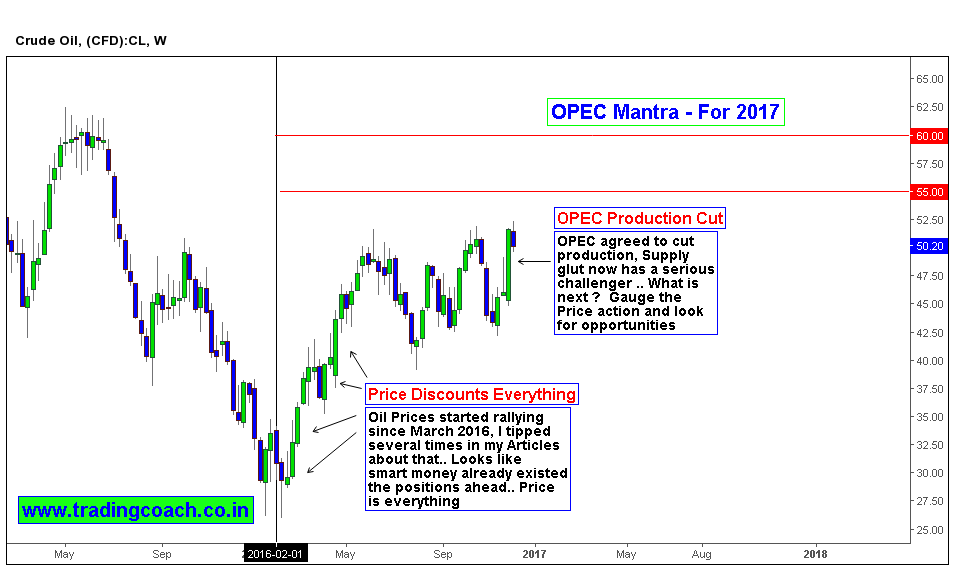

Despite catchy news events and geopolitical fears, Crude oil hasn’t changed much. Prices are still trading inside long-term range (which is clearly visible on

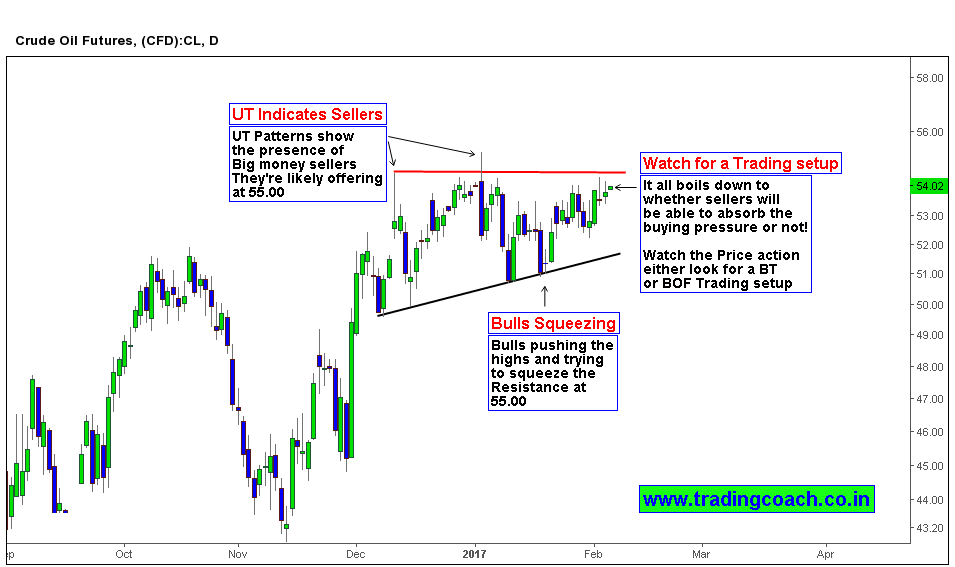

So far Speculative positions are driving Crude Oil Price action, especially preceding the breakout failure around 51.50. From the beginning of 2017, Bulls tried

Crude Oil can offer a Price action trading setup as it edges near the Inflection point at 55.00. Inflection point or Decision Point is

OPEC producers, despite the obstacles agreed to limit the crude oil production and the oil prices sustained. Now the Question is “Will the OPEC