Most of the traders who start their trading, always wonder which time frame would be suitable for them. We all know that there are different types of trading style from scalping to positional trading. So to be better trader, first and foremost you should choose a better time frame that suits your trading style and circumstances. I have already discussed more about timeframes in this earlier article.

So in this content, let’s discuss which time frame would be best suitable for market participants.

In a nutshell, there are two different categories of timeframe:

a. Lower Time Frame – Ranging from 1 Min to 15 Min

b. Higher Time Frame – Ranging from 1h to 1D

Trading in Lower Time Frame

Lower Time Frame consists of 1-minute to 15-minute Chart. Even though trading in lower time frame will allow you to find many trading opportunities, it is not advisable for beginners and intermediate level traders. The movements of price action in lower time frames are fast, which makes it more risky to trade them.

Also the trader will have to make sure he is present in front of the screen during the market hours to check and modify his trades. If you’re a part-time trader, sitting in front of the screen for an entire trading day seems highly unreasonable.

Problem of Algorithms and HFT

In this age of algorithmic trading, big players and institutions use highly advanced computer program such as High frequency trading to execute trades.

With such algo trading, one can easily execute thousands of trades within a short period. Such fast paced high frequency trades can cause frequent price swings and highly volatile market conditions, making it difficult for an average small-scale trader to trade in lower time frames. So when you’re trading in lower time frame, you need to understand that you’re competing with these highly advanced computer programs!

Hence, one must be aware of the disadvantages in trading lower time frames

Disadvantages of Lower Time Frame

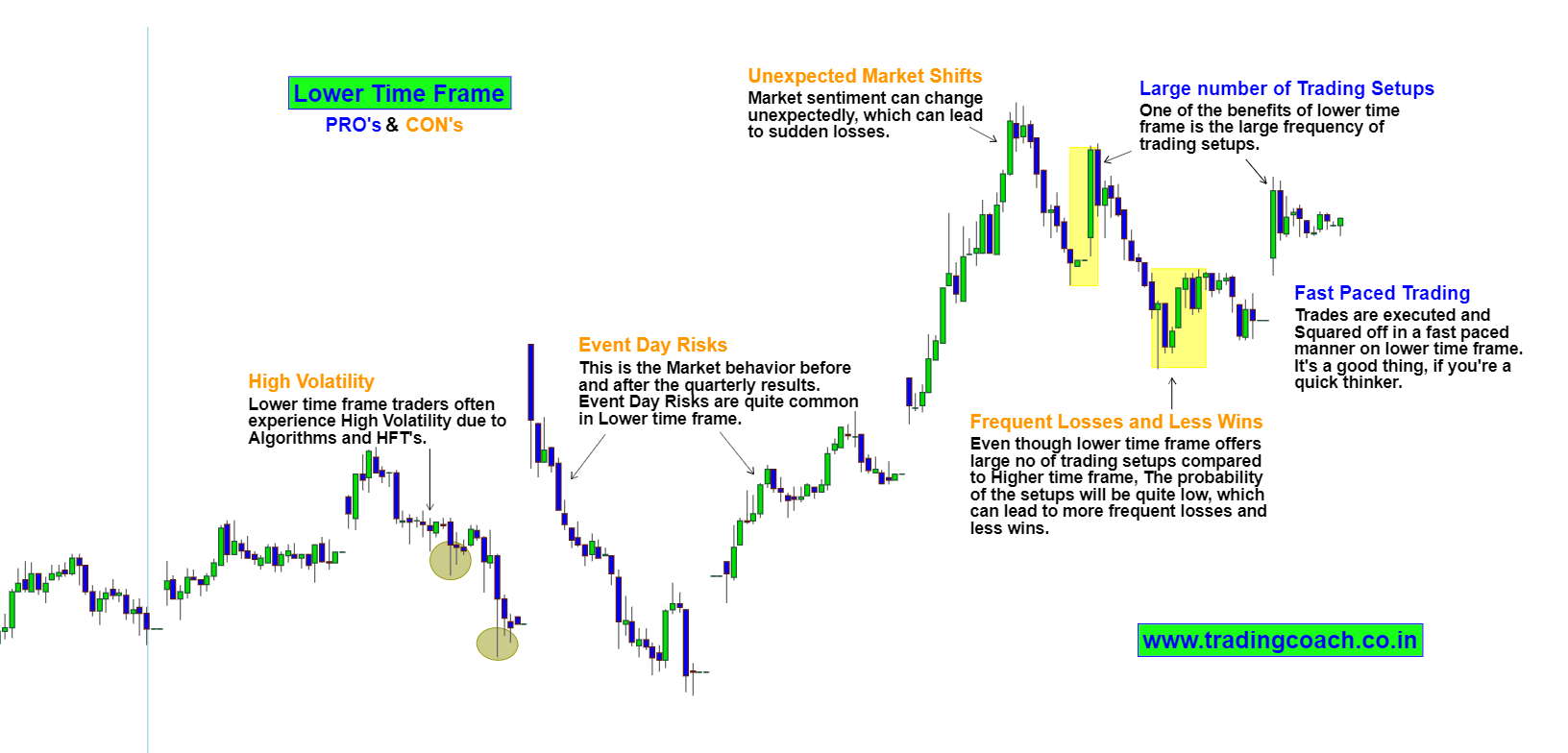

Trading lower time frames can ensure large no of trades but also has significant risks associated with it, such as:

1. Less Wins & More Frequent Losses

In my experience and what I have learned from teaching other traders, one of the biggest cons of trading lower time frame is that you can lose your entire trading capital in a short period. Lower time frame traders experience more frequent losses and less wins. Hence one needs to adopt a successful trading strategy that ensures high probability trades. A single wrong trade without a defined risk management can wipe off all your profits that are made for 3 – 4 days, within minutes! Hence, before trading in lower time frame, you need to make sure your trading strategy has a good probability and risk orientation.

2. Event Day Risks

Event Day refers to the trading day on which there are major news events such as Monetary Policy, Quarterly results etc. Event days come with lots of risk as they have the power to change the entire market sentiment. One should be particularly careful on event days, especially if they are trading on lower time frame. Price action will be extremely volatile on such days and can lead to big losses if the trade is executed without a proper risk management.

3. Psychological Effect

Impulsive trading is very common on lower time frames. Fast paced price movements often cause you to react emotionally. Since the time for thinking and planning is very less on lower time frames, it can lead you to make emotional trading decisions. We all know that trading and emotions do not go hand in hand. The price movements in lower time frame are so fast it always has a psychological effect on the trader

An experienced trader who can overcome these disadvantages can choose to trade in lower time frames. But for others, it’s better to avoid trading in lower time frame to minimize the risk of ruin.

Trading in Higher Time Frame

The higher time frame charts include 1 hour to 1 Day time frame. Higher time frames have a slow price movement. This will allow the trader to have some time duration before planning the trades. The formation of trading setup in the higher time frame charts can take time. It can take hours, days or even weeks for the trade formation to take place. But due to this time difference, you can easily enter and exit from the positions, as well as manage the trades.

Even if you’re a day trader, Swing trader or Positional trader, you can use and trade based on higher time frame charts using Price Action Strategies. If your trades are based on price action, it is much more feasible for a trader to create positions based on higher time frames rather than lower time frames.

Here are some advantages of trading in higher time frame

Advantages of Higher Time Frame

Though the frequency of trades will be less on higher time frame and you may need to have a lot of patience, but trading higher time frames have its own benefits

1. No need to stay in front of the Trading Screen

The biggest advantage of trading in higher time frame is that, one doesn’t have to sit in front of the screen for the entire trading day. Due to the slow price action, one may need to wait for the trading setup patiently but at the same time it is not necessary to sit behind the screen all day. One can easily analyze the price movement after-market hours and enter into positions based on their analysis. Also it’s quite convenient to watch your positions on higher time frame charts in a regular interval such as 2 hour, 4 hour or even daily once!

2. Better Control of Emotions

Trading in Higher time frame will give you a better control of your emotions. The slowest price movements give you enough time to properly analyze and take calculated risks. This also ensures that you don’t react emotionally while taking trades. When you are less emotional, it helps you to make better trading decisions. Since you won’t spend most of the time in front of the screen, it helps you to avoid overtrading and other psychological mistakes

3. Better Risk-Reward Opportunities

Some common arguments for trading in Lower time frame are like this – “I will get a better stop-loss” “My trading capital is less” “My stop-loss will be less and Target will be more in lower time frame chart” etc. It could be true that your stop-loss might be less, but the frequency of prices hitting your stop loss is very high on Lower time frame! Contrary to that, higher time frame trades will have a wider stop-loss, but also gives a better target level. As the average range movement is bigger in higher time frame charts, wider stop-loss is often compensated by wider targets. This ensures a lesser chance of your stop-loss getting hit and a better Risk – Reward on the trade.

As A Conclusion

Every trader has a different style of trading. Some may trade with lower time frame charts while others may look at higher time frame charts. Even though both have their own pros and cons, in my experience it’s always better to trade on higher time frames.Lower time frames have an advantage of frequent trading opportunities, but they are also associated with high risks. It may not be suitable for all traders.

Higher Time Frames ensure that one can easily analyze price action at a longer period and take better trading decisions, but it also requires the Virtue of Patience. After all, Patience is what makes a good trader!