Trading edge is the precise reason behind seeking trading systems and trading strategies. Traders spend hours, days or even years, to find trading edge in mechanical systems, trading strategies and discretionary methods. Trading edge is what differentiates between winning and losing. It creates a line in the sand between trading and gambling. It separates successful market sharks from small fishes. Trading edge is all; you need to be a successful trader. But the problem is most traders misunderstand the meaning of trading edge.

THE PROBLEM WITH DEFINING TRADING EDGE

What is trading edge? Why is it so potent in this business? Let me explore this powerful topic in a simple way… Trading edge can’t be defined in a straight forward way, we need to understand trading edge by the relationship it has with various trading concepts.

Most of the time, Market prices are efficient, which means market price is a fair reflection of value.Available information is discounted by market in a fraction seconds to hours. Most time, Price action fluctuates in a random fashion. In other words- Trading is a zero sum game. It’s a random game similar to gambling. Without a proper trading edge, Traders are not different from gamblers. Even though a trader might be profitable without a trading edge in the short-term, it is impossible to profit in the long run. A trader cannot survive without a trading edge as long as randomness dominates the trading results.

MISUNDERSTANDING TRADING EDGE

Newbies are often tricked into focusing on performance psychology with positive thinking mindset. Most traders develop a kind of attitude, in which if they solve their psychological issues and find a right trading system, and then money would flow into their trading accounts. They believe this trading edge. Sorry! It won’t work that way. None these are trading edge. There is an entire industry which feeds and makes use of this attitude. Lot of tips providers, technical gurus and easy to win propagators often feed this kind of attitude in newbies.

Positive thinking, Risk management, discipline and proper psychology is all important parts of a trading strategy. These are not trading edge. It’s all useless, if trading system doesn’t have a positive expectancy.

This brings us into the concept of Positive expectancy and the relationship it has with the trading edge.

POSITIVE EXPECTANCY

A positive expectancy results when a trader identifies inefficiency at a particular location, where statistical edges are present and limit his trades only to those locations. These are the locations where markets are less random and most probably offer “a high favorable trading opportunity”.

If we think about Positive expectancy, then it’s not the entries and exits which creates the difference. No wonder that most traders concentrate on entries and exits, which is a bit misnomer. In all cases, trading can be reduced to a matter of identifying statistical edges and avoiding random moments. Other words, it’s not all about entries and exits – It’s about trades which give a statistical edge. We need to take only high probable trades, which have excellent risk – reward profiles and highest winning rate. This is “easier said than done.”

This is what matters in all cases, the factors of Probability (High win rate) and risk: reward, should interact with each other on every single trade. You need to have both in your method; one without the other is futile. Every trading strategy should have a winning rate of more than 50% and you should only choose trades which has high Risk: Reward.

DEFINING TRADING EDGE

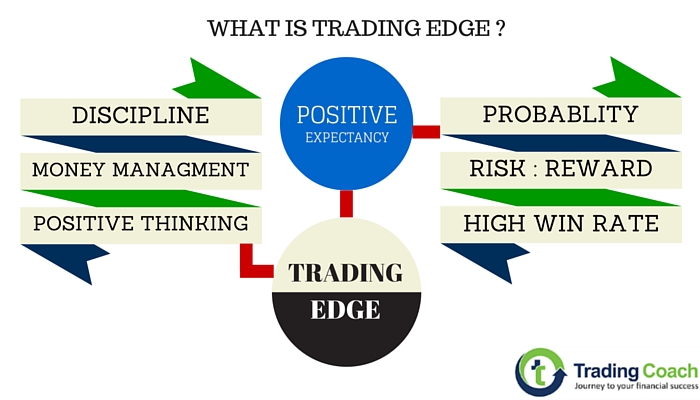

Still it’s quite hard to point out what is trading edge, in a precise manner, but I believe it’s easy to provide a visual cue of what it is. Hope the Image will give a clutter free definition of trading edge.

The conclusion is you must have an Edge. If you’re not trading with a positive expectancy over the markets, everything else is a waste of time. Positive Expectancy makes up a large part of trading edge. But still Positive expectancy doesn’t make up everything. You still need to have positive thinking, Money management and Discipline. They combine together to form a trading edge. None of them are standalone concepts. Discipline, Money management, Positive thinking and Positive expectancy adds great value by forming a trading edge, and remember trading edge is trading success.