As most of us know There are TWO TYPES of trading:

1.Discretionary trading 2.Systematic Trading

As with every field in finance there is a large amount of misconception about discretionary trading, which is highly profitable and led some to believe such a type of trading is purely subjective-No! People have misunderstood the concept and definition of discretionary trading. Even if you are systematic trader you can use the power of discretionary trading for your advantage.

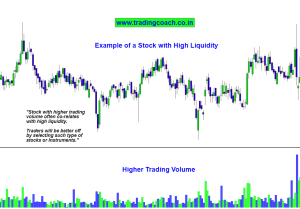

One characterizes Systematic Trading with the usage of computer models, mainly based on technical analysis of market facts to find and make trades; with limited manager intervention majority of the people who are in the retail side are these types of traders. One of the main issues in systematic trading is the lack of flexibility.

The opposite is Discretionary trading where flexibility is the key-Trading based on our Hidden intelligence and intuition. Discretionary Trading as defined by Trade-Ideas is the process of entering and exiting trades based on “feel”. The human brain is very adept at making different inferences while being with a large amount of information. This is a process where by watching the various recognition of the market via either looking at a chart negative and positive events a trader decides to buy-sell or refrains from trading. Trade-Ideas help in this type of trading by providing investors with an almost unlimited flexibility.

Which side do I adopt in my trading life? Simple- I am a Hybrid, and utilize best of the both sides. The best option for a Trader is to utilize the advantages of both Discretionary trading with a systematic process . Henceforth, combining best of the both worlds- regardless of their differences.

Process of combining discretionary and systematic trading.

If you need to use full potential to execute a trading tactic, the best option is to combine both Discretionary and Systematic trading. This is the example process of achieving maximum potential in the analytical process before executing a trade, which uses both system and logical mind as follows:

1. Once after a trade signal is generated – Reprocess the Signal based on Intuition

2. Imagine multiple scenarios following a trade signal

3. Try to pick out the most probabilistic scenario based on Logical Thinking

4. Execute the Analysis

By following the above process, we can arrive at some high probabilistic trade ideas using our intuition and logical mind.Such trade ideas can lead us into much profitable scenarios when systematic signals fail due to lack of flexibility.

The power of discretionary trading

6 of the 10 discretionary traders are either profitable or successful market players, so says the statistics. Some of the prominent and powerful market giants such as JP Morgan, Carl Icahn, Warren buffet all fits in this category. Discretionary trading is decision based trading, where the trader decides which trades to make, based upon the information available at the time. A discretionary trader may still follow a trading system with clearly defined trading rules, but will use their discretion (hence the name discretionary trading) to decide whether to actually make each trade. For example, a discretionary trader might check their charts and find that all of their criteria for a long trade have been met, but decline to make the trade simply because they believe that the price is too high. Such a kind of process encourages the power of human mind at the same time leads into emotional intelligence and logical decision-making which is essential for a profitable trader.