Gold continued to trade randomly so far in this week, following a drop on Friday due to better than expected US economic reports and momentum of US Dollar. Several times in previous articles, I emphasized the correlation between US economic status, Dollar and Gold. Investors, Traders should pay close attention to US because Gold prices are sensitive to these factors. Price action fell from $1365 after retesting the resistance level $1350.

For Buyers to win the battle of market sentiment, Gold should clearly push beyond $1350 because in all other circumstances it is hard to gain confidence on precious metals. The recent jerk in Gold prices can be attributed to liquidation by Asset managers, retail funds and those who were wrong footed by positive employment numbers and wage gains in US Labor data.

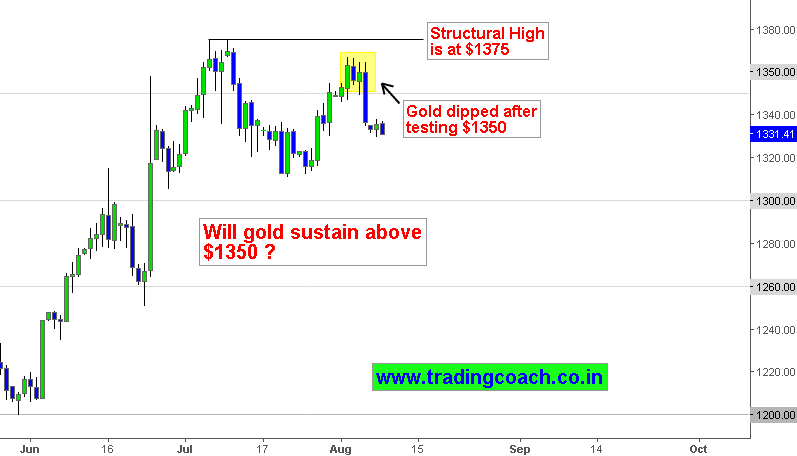

Price action fell after testing resistance zone $1350

Gold fell sharply after touching $1365 which is precisely above the technical resistance $1350. Selling tendency is clearly visible at the level. Sell off coincided with US labor data released on the same day. Market didn’t tested the structural high at $1375 instead gold sold off before crossing the key level after the release of Labor. Hedge funds also later trimmed their positions during the week according to Commitment of Traders Report.

In order for Bulls to dominate the sentiment, Price action should clearly break and retest the Key level $1350. Market offered some subtle clues before the structure shifted from trend to sideways.

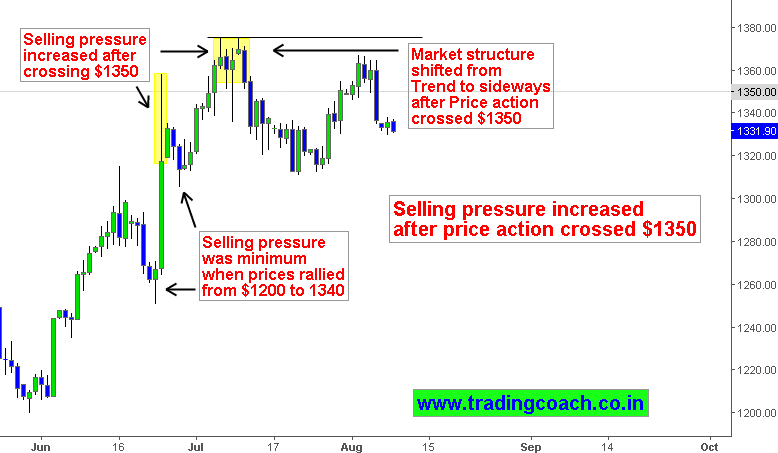

Candlestick spiked and selling pressure increased after crossing $1350

Gold rallied from $1200 to $1350 during the month of June – July. At that stage selling pressure was bare minimum. The metal offered structural pullbacks and temporary retracements on both higher and lower time frame. Behavior dramatically changed after price action crossed $1350, we can see a Bullish candlestick spike and a strong selloff when prices touched $1380. The sudden increment of selling pressure caused a shakeout of weak hand traders. As a result of selling pressure, Market structure shifted from Trend to sideways.

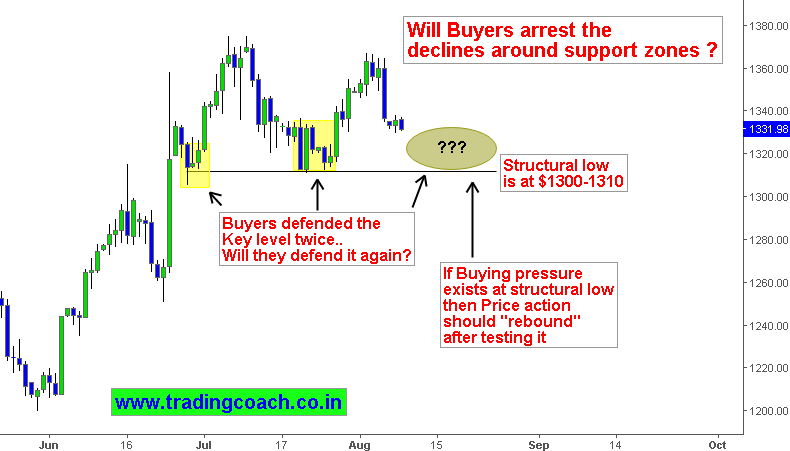

Gold Technical analysis – Buyers must defend the support level to sustain

There’s a possibility of price action testing structural low at $1300-$1310. Buyers defended the structural key level twice before. Technically, smart money players might test the support level again to asses the conviction of buyers and momentum of selling pressure. If buying pressure exists at structural low then Price action should rebound after testing it. Buyers should be able to arrest price declines; failure to do so might again increase the momentum of selling pressure. Traders should watch this closely.

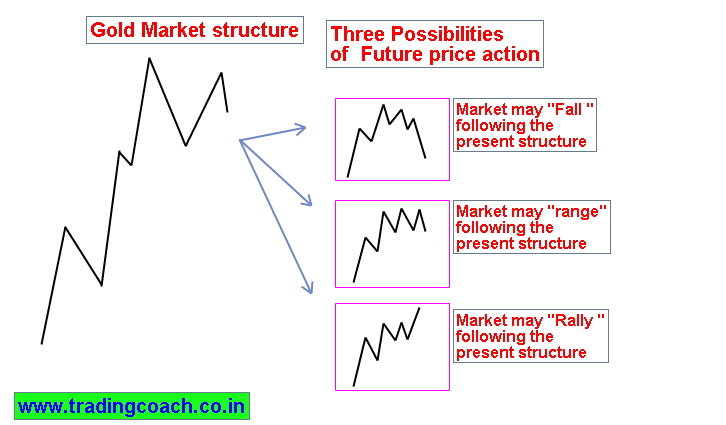

Price action trading – Three different possibilities of Market structure

Based of the current Market structure, we can asses three different scenarios about future market direction. Anyone of these scenarios will play out according to upcoming fundamental information and Price action. Traders should be intact with buying and selling pressure and focus on US Economic events-Data’s. Depending future information flows and structural formation, we can conclude which one of these scenarios might play out.