Biocon share prices fell nearly 10% on Monday after the Company’s subsidiary made an acquisition deal with the US-based healthcare company Viatris.

The Price Action is quite interesting, as we can see Rejections, traps and Big Money movements in the Stock.

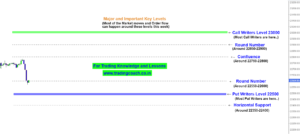

Market Structure wise, shares are trading in a broad range between 390 – 325. Take a look at the Price Action Analysis on the 1D Chart…

Biocon – Price Action Trading Outlook on Daily Timeframe

The Major Support zone is at 325 and the major resistance zone is at 390. Apart from these two major areas, we can also see that Price Action has formed a Mid Support zone at 350.

Prices broke the Resistance Zone in the first week of Feb, but the breakout didn’t sustain and turned into a False Breakout. Most traders and Investors who bought the stock during the Breakout are trapped by the Price Behavior.

Post the Acquisition deal on Monday, Selling Pressure increased sharply on the downside. We can witness a clear Momentum reversion taking place on the stock.

Apart from these factors, we can also notice the declining volume, which could be an Indication of Big Money Orders exiting from the stock before and after the acquisition deal.

To understand the related Price Action Concept, take a look at the video link given below.

Based on these observations, Biocon stock prices are likely to trade within the Range with higher volatility in upcoming days.

If we see a strong momentum and Breakout from the Range, Price action can change into a trending structure. Traders should keep an eye on the Price Action and take decisions accordingly.