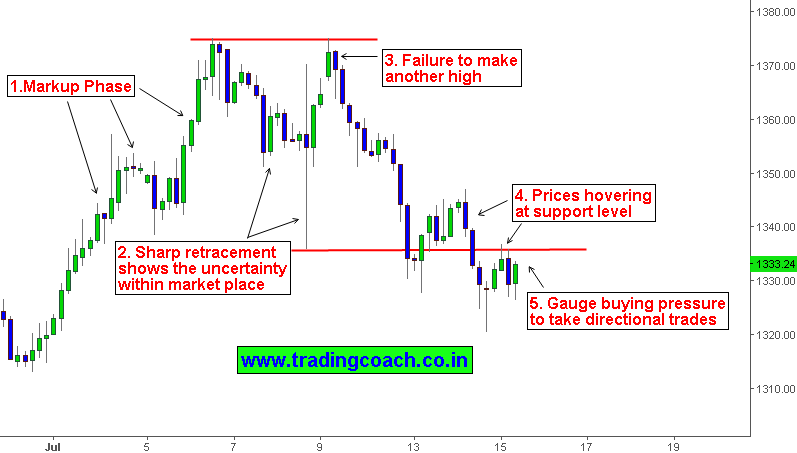

Gold dropped to two-week low fueled by liquidity factors and dampening Risk –off sentiment. Price action is consolidating around support level 1335.00. Commodity markets are becoming inversely correlated to Stock markets, as rise in stocks are contributing to dips in precious metals and vice versa. The behavior is due to fluctuating investors sentiment for risky assets. Gold declined in five of last six trading session is on the verge of a weekly loss since May. Market participants are sharply focusing on Support levels to gauge buying pressure.

Gold 4h chart for Price action trading

1. Gold is still up 26% when calculated on annual basis. Fallout from Britain’s vote to exit the European Union, Expectations of Monetary stimulus from countries such as Japan, UK has boosted the appeal of Safe haven demand in Gold. Prices made higher highs since the beginning of July, Technically referred as Mark up phase.

2. Better than estimated earnings pointed out economic resilience tested the metal’s safe heaven appeal and Investors confidence. These events caused gold prices to sharply retrace, creating uncertainty within marketplace. Largedoji candlestick we see on 8th July in 4h chart is a result of these scenarios

3. Finally around 11th July, Price action failed to make another high above 1375.00 hitting the last nail in coffin. Gold tumbled from there till 1335.00. The move coincided with Philadelphia FED president Patrick Harker speech pointing out FED might increase Interest rates twice before the year end.

4. Currently price action testing back and forth around Support level 1335.00. Technically, bad news about global economy and monetary stimulus bets are driving gold prices up, where Hopes of Economic growth and FED’s hawkish interest rate speeches are driving it down. Keep an eye on Global economic reports and monetary policy speeches to gauge buying and selling pressure in Gold. Next week’s price action might be interesting.