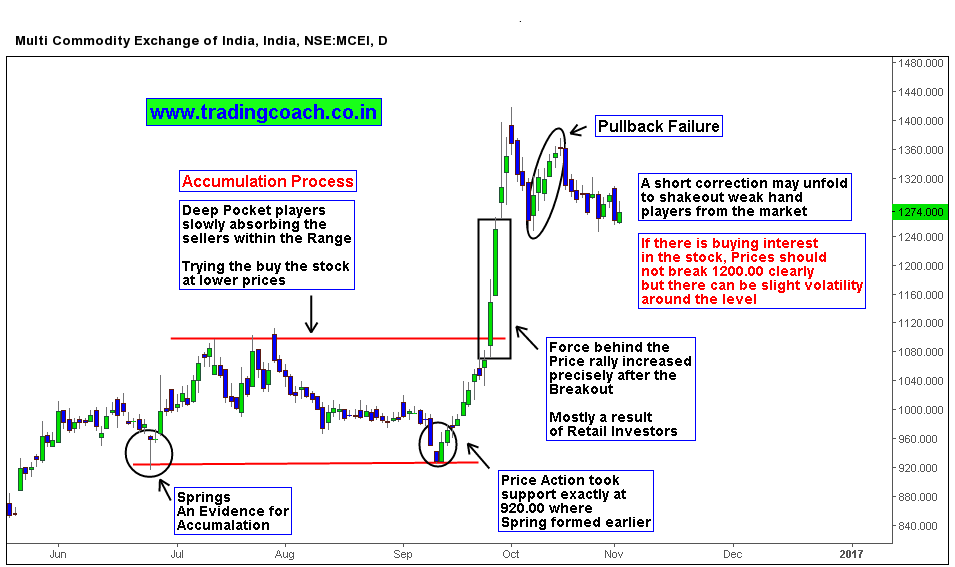

Following a strong Impulsive Breakout in the September (the move which lasted till the beginning of October) Price action turned into corrective structure composed of small candles lacking momentum and liquidity. Pullback Failure at 1400.00 forced retail investors to exit the positions creating a corrective selloff in the month of October. The correction may last till weak hand players are shaken out from the context and until the stock offers favorable discount buying opportunity for large money players. If there is real buying interest in the stock prices shouldn’t break the 1200 support level, but there can be breakout failures and volatile swings on the support zone.

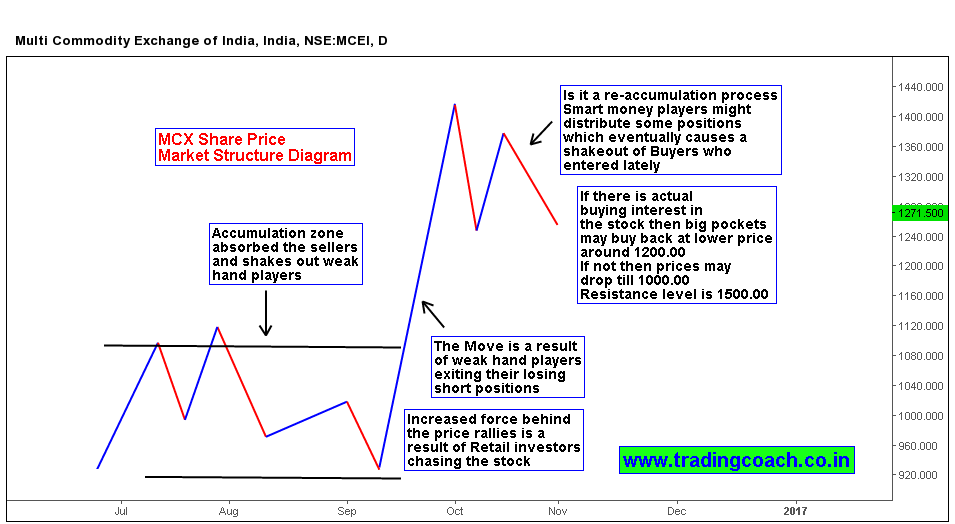

Using Market structure analysis, we can spot the actions of Smart money players. (More in-depth trading strategies for using Market structure are covered in my Premium trading course). In the case of MCX, we can see that Accumulation process took place during July – September in and around 1000.00 price level. The bullish impulsive breakout that followed the process is a result of retail investors chasing the stock. Logically, Smart traders may distribute some of their long positions which may eventually shakeout these late buyers from the stock and technically may create a favorable risk: reward opportunity for smart traders.

If there is real buying interest in the stock then bulls should bid the stock at 1200.00. There can be false breakouts and some volatile swings around the support zone 1200.00. In case if buyers fail to defend the level then prices may drop till 1000.00. Ideal resistance level is 1500.00 where strong offers may exist.

i want to know fees for advance course

Hi Kindly drop an email to info@tradingcoach.co.in or call us on +919108911590