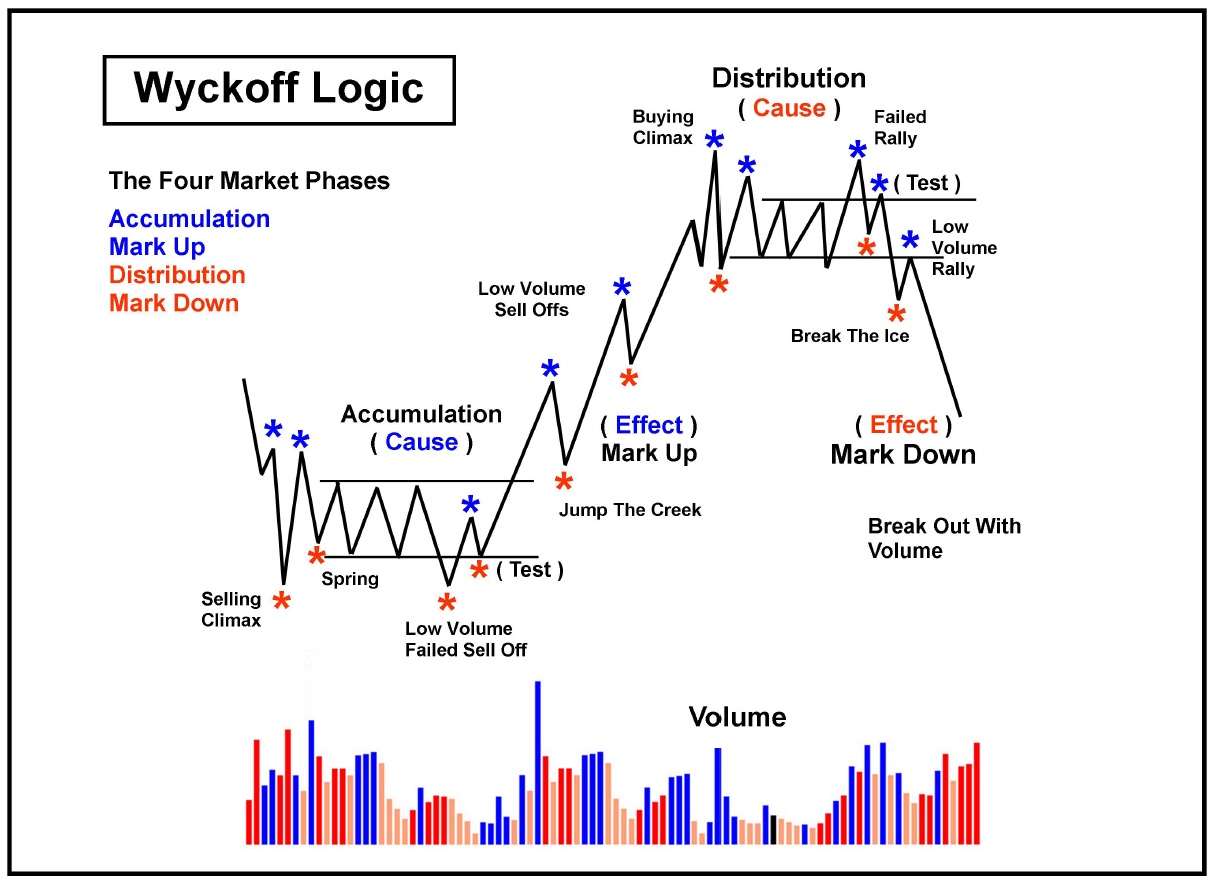

In one of our previous content, we discussed about Richard Wyckoff’s Accumulation and Distribution Phases and the critical role of Range trading in Wyckoff’s Techniques. The whole idea of Accumulation and Distribution comes under Wyckoff’s Trading Cycle.

Wyckoff Trading cycle is a model to interpret and analyze the price action of a particular Asset/Stock.

According to Wyckoff trading cycle, market prices move in 4 different stages:

● Accumulation

● Markup

● Distribution

● Mark Down

Here’s the picture of Richard Wyckoff’s Ideal Trading cycle:

As you can see the picture, Accumulation and Distribution, which we’ve discussed in the earlier content, are the stages in Wyckoff’s Price Cycle. So in this article let’s discuss about the other two stages in Wyckoff’s Price cycle – Mark Up and Mark Down, which are nothing but variations of Long term Uptrend and Downtrend.

What is Mark Up?

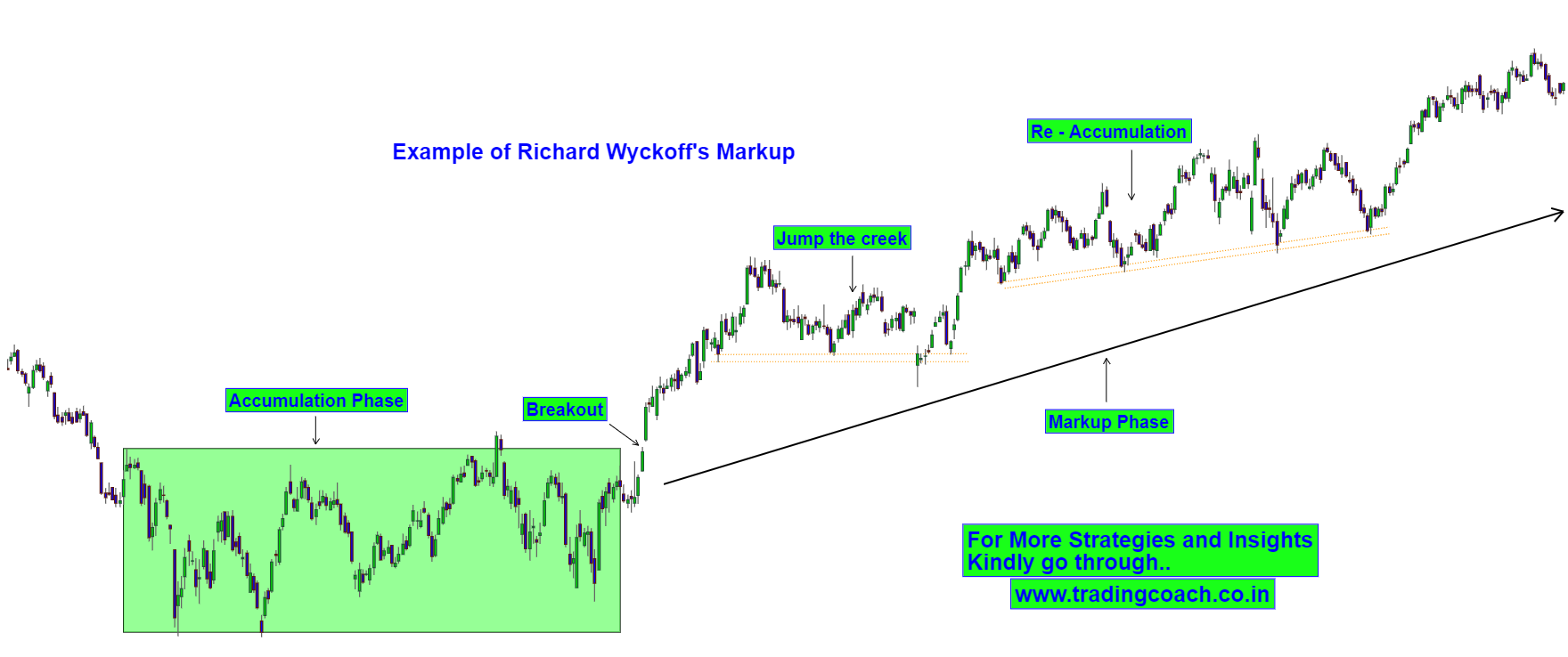

The Markup Phase is another stage in the Wyckoff trading cycle. It is preceded by the Accumulation phase. In the Markup phase, Price action will move into a Long term Uptrend.

This is the stage where price begins to make higher highs and breaks out from the Accumulation phase. Big Players would’ve completely acquired their positions which end up creating a significant buying power in the Asset/Stock.

Informed traders who are aware of this will jump on board with the trend and initiate bullish positions.

Markup Phase is the most profitable stage to own the Asset/stock. Most of the Growth and Value investing strategies works out well during this phase.

Wyckoffian Patterns in Markup Phase

Here are the 3 Major Wyckoffian patterns that occurs in Markup Phase:

Upside Breakout

Once Big Players or Smart Money Traders completely acquire their positions within the Accumulation phase, overall demand Increases in the Asset/Stock. As a result, price action will rise up and breaks the Resistance of the Accumulation Range. This Breakout reflects strong buying pressure and further attracts the long term buyers. As a result, prices will begin to move higher.

Jump the Creek

It’s a major retest that occurs right after the Upside breakout. This is the point where uninformed traders try to sell the Asset/stock without the awareness of Long term Markup phase. Prices could temporarily fall but eventually rise back to move even higher. Uninformed traders who sold the Asset/stock will get trapped by this formation.

Re – Accumulation

Re – Accumulation is a sideways range similar to Accumulation Phase, except for the fact that it happens within the Long term Uptrend/Markup. It’s an indication of Big Players or Smart money traders, buying the Asset/stocks within the Uptrend. Support zone will hold strongly in Re – Accumulation pattern. After the Re-Accumulation pattern, Prices will continue to move even higher.

What is Mark Down?

The Markdown Phase is another stage in the Wyckoff trading cycle. It is preceded by the Distribution phase. In the Markdown phase, Price action will move into a Long term Downtrend.

This is the stage where price begins to make lower lows and breaks down from the Distribution phase. Big Players will liquidate their positions which end up creating a significant selling power in the Asset/Stock.

Informed Traders, who are aware of this, will either square off their existing long positions or initiate bearish positions.

Markets can be very volatile during the Markdown Phase. Short Selling can give significant returns during this stage.

Wyckoffian Patterns in Markdown Phase

Here are the 3 Major Wyckoffian patterns that occurs in Markdown Phase

Downside Breakout

Once Big Players or Smart Money Traders completely liquidate their positions within the Distribution phase, overall demand decreases in the Asset/Stock. As a result, price action will fall down and breaks the Support of the Distribution Range. This Breakout reflects strong selling pressure and further attracts the short sellers. As a result, prices will begin to move lower.

Break the Ice

It’s a major retest that occurs right after the Downside breakout. This is the point where uninformed traders try to buy the Asset/stock without the awareness of Long term Markdown phase. Prices could temporarily rise but eventually falls back to move even lower. Uninformed traders who bought the Asset/stock will get trapped by this formation.

Re – Distribution

Re – Distribution is a sideways range similar to Distribution Phase, except for the fact that it happens within the Long term Downtrend/Markdown. It’s an indication of Big Players or Smart money traders, short selling the Asset/stocks within the Downtrend. Resistance zone will hold strongly in Re – Distribution pattern. After the Re-Distribution pattern, Prices will continue to move even lower.

Trading the Markup and Markdown

As you can notice, Markup and Markdown phases are similar to traditional uptrend and downtrend. The only difference is that, they’re long-term trends that occur in Daily and weekly timeframes.

According to Richard Wyckoff, one can trade the Markup and Markdown phases by first recognizing them and then taking positions within them using the Wyckoffian patterns.

Patterns like Upside breakout, Jump the creek, Re – accumulation will help to take long positions within the Markup Phase. In a similar way, Patterns like Downside breakout, Break the ice, Re – distribution will help to take short positions within the Markdown Phase.

To systematically trade the Markup and Markdown phases, you should design an effective trading strategy based on the Wyckoffian patterns.

In the beginning stages you may require some practice to recognize and trade these patterns. But down the line it will help you to spot excellent trading opportunities in trending markets.