Are you worried that you are barely breaking even in your day trading? Another day has gone by and you have worked around the clock. Make no mistake of losing money, rest assured you are not alone. Break even is a significant trading milestone. To be profitable is to make more than you spend. If that is the case, you need to fine-tune your trading approach.Here are few simple ways to drive profits in your day trading, regardless of your trading style:

1: LIMIT YOUR INTRADAY TRADES PER SESSION

Traders place stop limit order with the brokers to limit the loss on a position in a security. The stop-limit is a form of risk management and takes the emotion out of trading decisions. Most of the traders focus on the monetary outcomes even when these rules do workout. Every trader must think beyond money to focus on the quality of each trade and to drive profits in their day trading.

To meet this you must limit the number of trades in each trading session and this helps you to carefully select your trades. Limiting your trades per session results in improved quality trading which in turn makes your day trading profitable over time. This type of day trading prevents sloppiness in trading actions and keeps you fully engaged.

2: FOCUS ON MARKET VOLATILITY

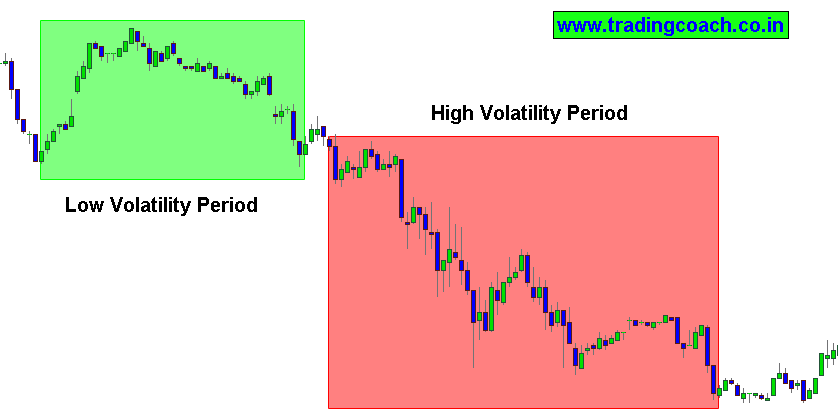

The best trading hours are when the volatile levels are highest. Trading during high volatile hours mitigates losses as price fluctuations are higher and yields larger profits. A trader makes most of his profits during the most volatile time of the day. Similarly; a day trader loses his profits when the rapid growth of price is followed by a drastic fall.

Most of the day traders believe in trading the entire session which is not true. Every trader must focus on identifying specific trade setups or price action patterns during volatile hours and avoid the period when the market is in range. This strategy improves and increases your day trading performance and time. For understanding the most volatile hours, traders can view the length of the candles on hourly chart.

3: TRADE ONLY VOLATILE MARKETS

Volatile markets are highly complex. Some of them move rapidly and others meander aimlessly through the day.

For a successful day trading, it is beneficial to understand the volatile market behaviors. You can improve your understanding by observing the vigorous changes in Price action during volatile hours. One way to deal with volatility is to pay attention to the trading activity of each market on volatile and non volatile periods, and analyze the price swings associated with it.

Greater volatile markets yield greater profit potential.For effective day trading and to maximize your profits, volatility is crucial. Volatile markets produce greater moves in a shorter time and help you to use your day trading capital efficiently.

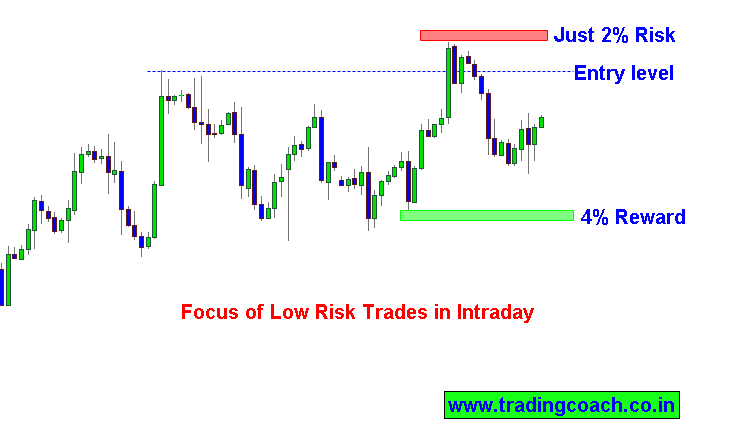

4: LOW RISK TRADING IS KEY

Low risk trading helps you to pay attention on how much you lose instead of how much you can earn. Part of successful trading is to limit the losses and preserve the capital. Low risk trading is the key strategy in any volatile market.

A volatile market has rapid growth and drastic fall in price and generally has higher risks with high return. Having a low-risk preference in this scenario provides you with a high reward-to-risk ratio. You can look for Price action trading setups like Breakout failures or false breakouts which are usually less risky in comparison.

MAXIMIZE YOUR PROFITS BY DECREASING YOUR TRADES

To maximize your day trading profits, you must keep your trading limited and specific. Instead of focus on every move, pay attention only to less risk and high reward setups. Many traders believe that trading more maximizes their day trading profits which is not the right strategy. For a profitable day trading you must:

1. Focus only on 1 or 2 instruments or assets for trading.

2. Keep the number of hours you spend in the markets in limit.

3. Take trades based on risk – reward principle.

4. Have Flexible risk management technique.

Happy Trading Folks !

1 thought on “Break even in Day Trading ? Follow these Ideas to be Profitable”

Its very helpful sir,thank uvery much.